We wish you all the best for Christmas and the New Year.

We will close on Wednesday 21 December, 2022 at noon and re-open on Monday 9 January, 2023 at 9.00 am.

Trade mark renewal scams - Unofficial invoices - Cyber security

If you have a trade mark registered with IP Australia be wary of fake renewal notices e.g. from IP Office. Renewal of registration is required every 10 years. A fake invoice may have the renewal date wrong and charge three or more times the actual renewal fee

If you have a trade mark registered with IP Australia be wary of fake renewal notices e.g. from IP Office. Renewal of registration is required every 10 years. A fake invoice may have the renewal date wrong and charge three or more times the actual renewal fee

(IP Australia - Unoffical invoices)

The Optus and Medibank hacks have been in the news. If big businesses can be hacked what can a small business do? The Australian Signals Directorate operates the Australian Cyber Security Centre (ACSC) and provides helpful information.

(ACSC Small business cyber security guide)![]()

(Australian Tax Office 3 cyber security tips)

"Bankruptcy can assist a young couple to get past their swamping financial problems, start creating a financial future and get on with life." Alan Nicholls of Nicholls & Co Chartered Accountants

(Article by Nicholls & Co Chartered Accountants Specialists in Bankruptcy)

Side hustles - What are the legal and tax complications?

Side hustles - What are the legal and tax complications?

More Australians are now taking on a second job to relieve cost of living pressures. But is the extra money worth the amount of tax payable and time it takes up?

(Article UNSW BusinessThink 12 Oct 2022)

We are OPEN & propose to remain open & available as much as possible despite COVID

Some of the legal services we provide are essential. For instance, sales and purchases still need to go ahead. You should not put off signing a will. If stay at home rules apply we will be available for critical legal work.

We are fully vaccinated and follow recommended health protocols. Please telephone or email us first if you have any concerns. If you are unwell with flu-like symptoms; if you have travelled overseas recently; or if you have been in contact with anyone at risk of having contracted Covid-19, we ask that you call us before coming into our office. Entry to our office is conditional on compliance with government health orders.

We need to behave and think differently in these extraordinary times. While maintaining social distance and good hygiene we should try to stay connected, reach out to those isolated and work together as a community.

Free eBooks - Families & women and the law

Catherine Henry Lawyers in Newcastle have available a number of helpful free ebooks including Your Body Your Health: A legal guide to women's health; Women and the Law; Families and the Law; and National Disability Insurance Scheme.

(Free eBooks by Catherine Henry Lawyers)

Foreign persons surcharge purchaser duty

Foreign persons surcharge purchaser duty

Surcharge purchaser duty of 8% is calculated on the dutiable value (the greater of the purchase price or value) and is paid in addition to transfer duty payable on the acquisition of residential-related property.

Individuals acquiring an interest in residential-related property in NSW are not considered a foreign person if they are an Australian citizen or ordinarily resident in Australia. Individuals who are not an Australian citizen or ordinarily resident in Australia as at the liability date, will not be liable for Surcharge Purchaser Duty if they meet the requirements of an exempt permanent resident.

A problem many have encountered is that even if your visa grants you permanent resident status you are considered a foreign person if you have not lived in Australia for at least 200 days in the 365 days prior to the date of the contract for purchase of the property. To prove you are ordinarily resident in Australia, you have to provide movement records from the Department of Home Affairs for the 12 month period before the contract date.

(See Revenue NSW site Overview and Types of individuals)

GST concessions for Not-For-Profits (NFPs)

The Australian Tax Office (ATO) has updated its guidance to clarify the GST concessions for eligible NFPs.

(ATO web guidence - GST concessions for NFPs)

How do we future-proof access to our data?

Darryl Browne, principal solicitor of Browne Linkenbagh Legal Services in the Blue Mountains, makes the interesting observation, "if a person had some really important information, people would put it in an envelope, seal it, sign it and give it to the solicitor who would put it in safe custody. If we do that now, two weeks after [the solicitor has been] given the envelope, the username or password has changed."

An executor will want access everything, for instance cryptocurrency, but Toby Blyth, partner at Colin Biggers & Paisley points out, "but the person that is leaving the estate might not want everything handed over."

Home buyers shared equity schemes - State & Federal

Home buyers shared equity schemes - State & Federal

Both the NSW and Federal governments have announced shared equity schemes. This is where the government will pay a portion of the purchase price of a property and acquire an equivalent proportion of the ownership. Eligibility criteria must be met and conditions apply during ownership. The limited number of applications will be lodged through participating lenders.

(NSW government shared equity factsheet) (Federal government shared equity announcement)

New guide to resolving business disputes & mediation

The NSW Small Business Commission has released a new guide on its mediation service and how it can help resolve business disputes, potentially avoiding the time and expense of going to a court or tribunal.

(Download a copy of Resolving Business Disputes: A Guide to Mediation)

Nearly 300 people drowned in 2020-2021 - We need to learn to swim

Nearly 300 people drowned in 2020-2021 - We need to learn to swim

Submersion injuries can also have long-term effects. Australia is an island surrounded by water. It has rivers, creeks, dams and pools. Swimming is usually safe when the risks are managed. Search "learn to swim" in your area and there will be a number of places where adults and children can learn.

It takes time to learn to swim. A crucial thing is that we know how to swim at least enough to stay afloat and make our way to safety. Floaties on children should only be used with supervision that can save the child when they get into difficulty.

(Research into drowning in Australian waterways)

COVID-19 vaccination mandates - article & recent cases

The NSW Law Society Employment Law Committe has published an article about four recent decisions, which have received significant publicity regarding the requirements for people to be vaccinated.

In addition, a recent decision of the Fair Work Commission has emphasised the importance of consultation prior to mandating vaccination where there are enterprise agreements even when the employers direction appears reasonable and lawful.

(Article: Personal circumstances matter in employee vaccine refusal)

(Article: Mandatory COVID-19 vaccinations & public health order challenges)

There have been numerous recent unfair dismissal cases relating to vaccination. Most (if not all) applications so far appear to have been unsuccessful. To search the decisions in recent cases go to: Fair Work Commission. Enter "vaccination" as the search term where it says "Find decisions and orders" click on Search or press Enter or Return and the links to cases should then be listed. The links to some earlier cases are listed below:-

(Aucamp v Association for Christian Senior Citizens Homes Inc. [2021] FWC 6669 - Victorian directions - a valid reason for dismissal: the worker is not vaccinated against COVID-19; does not have a valid medical exemption; and cannot perform their role as a result of a public health direction related to their vaccination status.)

(Case: CFMMEU & Matthew Howard v Mt Arthur Coal Pty Ltd T/A Mt Arthur Coal [2021] FWCFB 6059 - summary .pdf - sumary .htm - full decission)

Rewarding staff for getting vaccinated - Taxation reminder

Some employers reward staff for getting vaccinated e.g. cash payments, paid leave, transport to and from the vaccination and non-cash gifts, such as vouchers and gift cards.

The Australian Tax Office (ATO) reminds employers that if they have provided employees with a cash payment they must: include the payment in your employee's salary and wages; withhold tax from the payment amount under pay as you go withholding; include the amount in your employee's ordinary time earnings (this is for the purpose of determining super contributions for your employees).

If an employer has provided non-cash benefits, they may have to pay fringe benefits tax on the benefits unless an exemption applies.

See COVID-19 vaccination incentives and rewards for employees & COVID-19 and fringe benefits tax

COVID-19 vaccine indemnity

COVID-19 vaccine indemnity

The Australian Government is reducing the claim threshold of the no fault COVID-19 Vaccine Claims Scheme to enable more people access to compensation for costs associated with a vaccine injury.

Australians will now have access to compensation from $1,000 for COVID-19 claims related to the administration of a Therapeutic Goods Administration (TGA) approved COVID-19 vaccine delivered through a Commonwealth Government approved program.

(COVID-19 claim scheme)(See Australian Department of Health) (COVID-19 (Coronavirus) statistics)

Mental health and wellbeing toolkit

Thomson Reuters' Practical Law has published a detailed guide to content addressing mental health and wellbeing. Although written for the legal profession it covers a range of topics applicable to everyone: personal effectiveness, effective communication, emotional intelligence, impact of COVID-19, managing stress and mindfulness. Unfortunately, it's not free but there are free trials for some sections.

(Mental health and wellebing toolkit)

First home buyer choice - Annual property tax

From mid-January 2023 eligible first home buyers will have a choice of paying an annual property tax or stamp/transfer duty if they are not exempt.

From mid-January 2023 eligible first home buyers will have a choice of paying an annual property tax or stamp/transfer duty if they are not exempt.

For purchases up to $650,000, an eligible first home owner would be exempt from stamp/transfer duty so there would be no reason to opt for an annual property tax. For purchases $650,000 to $800,000 (entitled to a concessional exemption) up to the property tax limit of $1.5m a comparison will have to be made between paying stamp/transfer duty or an annual property tax for the time the property will be owned.

(General fact sheet from State government) (Article by Pitcher Partners) (First home buyer choice calculator - Revenue NSW)

NAIDOC Week 2022 from 3 to 10 July

This year's theme of NAIDOC Week is "Get up, stand up, show up" which aims to gather support to secure reforms for Aboriginal and Torres Strait Islander people. The theme also celebrates the many people in the community who have driven and led change for Indigenous Australians across generations.

National Reconciliation Week 27 May - 3 June 2022

The theme for National Reconciliation Week in 2022 is Be Brave. Make Change. It asks all Australians to be brave and tackle the unfinished business of reconciliation so we can make change for the benefit of all Australians.

iWitnessed - Witness report capture app

iWitnessed - Witness report capture app

The iWitnessed app helps collect and preserve eyewitness evidence. It has useful features to help witnesses and victims record the details of the event they experienced.

iWitnessed has been designed by Psychological scientists at Sydney University who are experts in eyewitness memory and police interviewing.

iWitnessed uses a guided recall procedure that has been designed to maximise the value of the information recorded while also helping protect your memory of the event.

Law Week 16 - 20 May 2022

During Law Week and at other times the Dubbo Regional Library has legal resources available. The Dubbo Community Legal Centre and Legal Aid are also providing information sessions. Also go to the NSW Law Society's Lawfully Explained webpage.

Trivago fined $44.7 million for false or misleading representations

Trivago fined $44.7 million for false or misleading representations

The Top Position Offer was often not the cheapest price. It was found that the website only displayed offers made by online booking sites that agreed to pay an amount to Trivago (the cost per click) exceeding a minimum threshold.

(Australian Competition and Consumer Commission v Trivago N.V. (No 2) [2022] FCA 417)

New directors must now have a director ID

The Australian Business Registry Services (ABRS) is responsible for director IDs and is contacting new directors appointed for the first time after 1 November 2021, who have not met their obligation to apply for a director ID.

From 5 April 2022, new directors appointed for the first time must apply for their director ID prior to their appointment. ASIC is responsible for enforcing director ID offences.

For more information visit - abrs.gov.au/directorID

Lawfully Explained - is an initiative of the Law Society of NSW

The site includes articles about your rights in relation to property, relationships, business and preparing for court. It provides a guide through the legal system and help with connecting to a solicitor that suits your needs.

Languishing & 5 Ways to Wellbeing website

Languishing & 5 Ways to Wellbeing website

Are you feeling somewhere between "flourishing" and "burnout"? The term "languishing" came up recently in a recent NSW Law Society seminar about wellbeing and the stress caused by the COVID-19 restrictions. The 5 Ways to Wellbeing is an Australian website providing some practical advice on wellbeing.

(5W2WB Factsheet - Tools & resources for individuals - Languishing New York Times article)

We wish you all the best for Christmas and the New Year.

We will close on Wednesday 22 December, 2021 at noon and re-open on Monday 10 January, 2022 at 9.00 am.

International Day of People with Disability - Thursday 2 December 2021

Scam Watch Week has passed but how prevalent are hacking attempts?

"Remarkably, the ATO defends against more than two million attempted cyber intrusions each month; in peak months (such as Tax Time) this rises to over 3.5 million intrusion attempts. The Commissioner summarised the ATO's challenge in these terms:

In an increasingly volatile global technology environment, we know that the odds are stacked in favour of potential attackers: while they only need to find one weakness to gain access, we have to defend against them on all fronts."

(Robyn Jacobson Senior Advocate Tax Institute TaxVin 26 Nov 2021)

Recovering from the pandemic - Keys to success

We talk about planning for natural disasters. How do businesses plan for the unexpected? We should plan for disruption to our businesses, even though we don't know what the cause might be.

Aaron Lucan, of Worrells solvency & forensic accountants in a seminar at Dubbo RSL Club on 12 November 2021, suggested a few things businesses could do:-

- Actively manage accounts

- Invest in employees (create a culture for retention, not too resistent to wage increases)

- Have a plan for dealing with uncertainty (for future closures or restictions here and overseas)

- Actively manage budgets

- Move with the market (invest in where the market is heading, online ordering, home delivery)

- Monitor solvency (think about "safe harbour", small business restructuring, voluntary administration)

(Where have all the insolvencies gone? And when will the volume return?)

National Scams Awareness Week (SAW) - Not the movies

The increase in people working online from home during the pandemic has seen cybercrime increase in Australia by 13% in the past year. In September 2021, the Australian Cyber Security Centre (ACSC) reported it had received one cybercrime report every eight minutes over the 12 months to June 30, 2021.

St George Bank & the ATO provide some examples of common scams and strategies to avoid them.

(See St George Bank website)(Australian Taxation Office (ATO) - Let's talk scams)

Director Identification Number (DIN or Director ID)

A director ID will be a unique identifier that you need to apply for once and then keep permanently. It has been introduced to try and combat phoenixing companies. Australian directors must apply for their director ID themselves using the myGovID app.

If you became a director on or before 31 October 2021 you must apply by 30 November 2022. If you become a director between 1 November 2021 and 4 April 2022, you must apply within 28 days of appointment. From 5 April 2022 you must apply before being appointed as a director.

If you became a director on or before 31 October 2021 you must apply by 30 November 2022. If you become a director between 1 November 2021 and 4 April 2022, you must apply within 28 days of appointment. From 5 April 2022 you must apply before being appointed as a director.

Directors of not-for-profit companies, for example companies limited by guarantee and Aboriginal corporations, will need to apply for a DIN or director ID. Directors of incorporated associations, unincorporated associations and cooperatives will be exempt.

(Australian Business Registry Services (ABRS) website)

Public health orders challenge dismissed

The plaintiffs contended that the NSW public health orders made in September 2021 were invalid. The orders related to aged care and education. The circumstances of the plaintiffs are summarised in paragraphs 95 -109 of the decision. The proceedings were dismissed.

(Kassam v Hazzard; Henry v Hazzard [2021] NSWSC 1320)

Mandatory Covid-19 vaccinations: are they lawful?

The employment law committee of the NSW Law Society has produced a helpful article. A snapshot of the points:-

- Some employers can require employees to be vaccinated.

- The Fair Work Ombudsman has updated its guidance for employers and employees.

- Generally an employee cannot refuse work because colleagues are not vaccinated.

"The coronavirus pandemic doesn't automatically make it reasonable for employers to direct employees to be vaccinated against the virus."

"... if an employer is considering implementing a vaccination policy mandating that some or all of its employees must be vaccinated, then it should carefully consider consulting with their employees (and any relevant trade unions) prior to implementation."

(Article by NSW Law Society employment law committee 27 Sept 2021)

Coming to Australia - A good news story

"... with Egypt still recovering, he [Ahmed Adbelwahed] worried about the opportunities available to his children. He tried living in the United States, but found it unsafe and felt the police were suspicious of him as a Muslim man from the Middle East.

"Come to Australia," a friend said. "In Australia all people are equal and you can live however you want." He flew to Sydney on August 3, 2018. His friends picked him up from the airport and took him to his new apartment, where they had stocked the fridge with food. People he had not even met helped him move his furniture and buy a car. "Why are you helping me like this?" Mr Abdelwahed asked. "It's not normal."

"Because here, we don't have any issues against each other," they replied. "All of us help each other to get better." ... He said he had never felt more welcome than he does in Australia. "I tell my friends that they're the best people I've ever met in my life."

Abolition of certificates of title for land in NSW

Abolition of certificates of title for land in NSW

NSW has been moving away from paper-based processes and toward the electronic lodgment of land transactions (eConveyancing). From 11 October 2021 certificates of title for land in NSW will be abolished. All records will be kept electronically by the land registry service.

Most "title deeds" for land were actually a certificate of title (CT). Existing CTs will be cancelled and CTs will no longer be issued. Existing CTs cannot be required to be produced to have a dealing or plan lodged for registration. Landowners and banks will instead receive an information notice.

If you have a CT you don't have to do anything with it. After 11 October 2021 the CT will not be a legal document. Don't destroy your CT just yet. Some transactions may begin before the cut-off date and be finalised afterwards.

Be careful what you post - Social media & the risk of defamation

![]() "The implications of the [High Court] judgment, however, extend well beyond media organisations. The effect is that every user of social media is a publisher of comments to their posts by anyone, irrespective of their knowledge or intention."

"The implications of the [High Court] judgment, however, extend well beyond media organisations. The effect is that every user of social media is a publisher of comments to their posts by anyone, irrespective of their knowledge or intention."

"The only responsible advice any defamation lawyer could now give to users of social media wanting to avoid the risk of being sued, short of disabling comments entirely, is to monitor them obsessively and remove anything that might remotely cause offence."

(Fairfax Media Publications Pty Ltd v Voller [2021] HCA 27)

(Article about defamation and the new serious harm test)

School successfully sued for student's abuse

In Victoria a student has successfully sued a school for negligence and was awarded $2,632,319.25.

(PCB v Geelong College [2021] VSC 633)

COVID-19 support package to help NSW businesses

(NSW Government's fiancial support for individuals & households)

(Summary of Federal & State financial support & requirements by Pitcher Partners)

(Covid concessions & support for business guide by Findex-Crowe)

Vale Peter Duffy (1934 - 2021)

Vale Peter Duffy (1934 - 2021)

Peter Duffy's recent passing leaves a void in the Dubbo community.

A great family man, sportsman and respected solicitor with wide experience. His retirement due to failing health was a loss to the Dubbo legal community.

Peter was compassionate and astute. He was always active in the community. He was a great support to those who worked with him and young solicitors.

It's a sad loss but fond memories of Peter and his stories lives on.

(Duffy Elliott Facebook page) (Funeral 24 September 2021 1:30pm livestreamed)

Dementia Action Week - is this week - 20-24 September 2021

The Dementia Australia website has some great resources for those people wanting to learn more about dementia, living with and caring for someone with dementia.

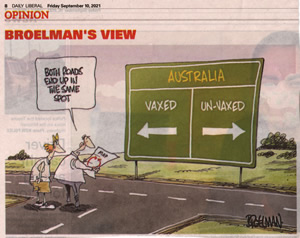

What about the unvaccinated that have recovered from COVID?

There has been a lot of discussion about insisting on vaccination and restrictions on the unvaccinated. I might be vaccinated but others may object to vaccination on the basis of health concerns, civil liberties, religion, morals or personal views.

Unlike some vaccinations, the current COVID-19 vaccines available appear not to provide total immunity. Vaccinated people may still contract Covid and pass on the virus. Although, their symptoms and ability to spread the virus may be greatly reduced.

It is likely that unvaccinated people will eventually contract Covid. The majority will survive and have some natural immunity. However, they may still contract Covid and pass on the virus just as those vaccinated can.

Announcements suggest that proof of vaccination will be required for some activities and travel. What about those who have recovered from Covid? Is it possible for them to be tested to show they have a level of immunity despite being unvaccinated?

Mandatory vaccination - is it lawful?

This raises quite a few issues, including: individual rights, freedoms & privacy; employer's lawful & reasonable directions; work health & safety for workers & customers etc; indirect discrimination; and conflicts between Federal & State powers to make health orders.

Mandatory flu vaccination has come before the Fair Work Commission recently and the applications for an unfair dismissal remedy have been unsuccessful. These cases involved aged care and child care.

These cases involved existing workers. They were not situations were the employment contract specified vaccination as a requirement of the job.

(Glover v Ozcare [2021] FWC 231 - was there a dismissal?)

(Glover v Ozcare [2021] FWC 2989 - mandated flu vaccination was lawful & reasonable)

(Barber v Goodstart Early Learning [2021] FWC 2156 - daycare policy, no exemption)

Staying well during COVID - shared by Bob Berry Real Estate

Online Safety Bill

The Online Safety Bill was passed in June 2021 and is expected to be in force by the end of the year. It will impact social media and internet service providers. The eSafety Commissioner is given extensive powers to prevent cyber-bullying of children, cyber-abuse material, non-consensual sharing of intimate images and other inappropriate material.

COVID-19 support package to help NSW businesses

"The NSW Government today announced a major new grants package and changes to the Dine & Discover program to help tens of thousands of small businesses and people across NSW impacted by the current COVID-19 restrictions. The package includes grants of between $5000 and $10,000 for small businesses, payroll tax deferrals for all employers, an extension of the Dine & Discover program to 31 August and the ability for people to use Dine & Discover vouchers for takeaway delivered directly to their home by the venue itself. Businesses will be able to apply for the grants through Service NSW from later in July and will need to show a decline in turnover across a minimum two-week period after the commencement of major restrictions on June 26." Law Society of NSW

(NSW Government's fiancial support for individuals & households)

(Summary of Federal & State financial support & requirements by Pitcher Partners)

(Covid concessions & support for business guide by Findex-Crowe)

Lorna Jane $5m penalty approved by court

Lorna Jane admited to representing to consumers in July 2020, by representing to consumers that "LJ Shield" makes the transfer of all pathogens, including COVID-19 to your activewear, impossible by eliminating the virus on contact with the fabric. The Federal Court was satisfied by the $5m penalty proposed by the ACCC.

(Australian Competition and Consumer Commission v Lorna Jane Pty Ltd [2021] FCA 852)

Fitness centre gym injury claim successful

Ms Powell was injured at a JFIT gym when she lifted a 25 kilogram weight plate from the floor to store it on a tree rack. The weight plate had been left on the floor by another user of the gym. She suffered disc protrusion and underwent multiple surgeries. She was awarded damages of $551,097.62. The gym appealed but its appeal was dismissed.

(JFIT Holdings Pty Ltd t/as New Dimensions Health & Fitness v Powell [2021] NSWCA 137)

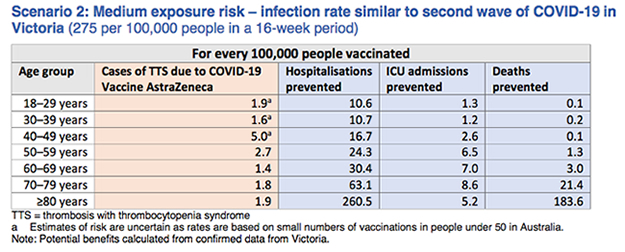

Weighing up the potential benefits against risk of harm from COVID-19 vaccine AstraZeneca

Sexual assault survivor awarded $2m compensation

"The Melbourne Archdiocese has been forced to pay a record $2 million in compensation after originally only offering $27,500 to a survivor of notorious priest Kevin O'Donnell. Source: Herald Sun.

David Kenter won the payout – the largest of its kind in Victorian history – more than 45 years after he was first sexually abused as a nine-year-old altar boy."

"We all have a responsibility to eliminate disgraceful and unacceptable behaviour in the workplace"

"Everyone in the legal profession should expect to work in an environment that is safe and free from harassment." (Juliana Warner, President of the Law Society of NSW - President's message)

Australian Taxation Office (ATO) likely to increase debt collection

"... the ATO collectable debt grew during 2020 from $26.6 billion to $34.1 billion with small business taxpayers accounting for approx. $21.4 billion (or 62.6%) of this figure. Chamberlains SBR advises, "... the more pro-active your clients are towards communicating with the ATO and entering where possible appropriate repayment accounts, the greater the chances are of continued support and the less the risk of personal exposure from an insolvent trading claim."

(Chamberlains SBR Report July 2021)

NAIDOC (National Aborigines & Islanders Day Observance Committee) Week 4 - 11 July 2021

This month in the Law Society Journal "we celebrate the extraordinary stories, diversity, voices and achievements of First Nations Australians - particularly those in the legal profession. We invite you to embrace cultural knowledge from your peers, and begin to envision how the legal profession may come together to be part of national healing." The Law Society of NSW CEO Sonja Stewart says: "If you can see it, you can be it."

(NAIDOC theme: Heal country, heal our nation)

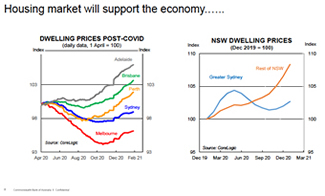

PEXA insights into the property market

PEXA insights into the property market

Property Exchange Australia (PEXA) provides an electronic platform to solicitors, conveyancers and banks for the settlement and registration of land transactions. Fortunately, it was in place when COVID-19 restrictions have had to be adopted.

The PEXA Insights report provides some interesting information and graphs for Sydney, Melbourne & Brisbane property markets based on settlements using the PEXA platform. (See PEXA Property & mortgage insights report)

Working From Home (WFH) Returning to Work (RTW) Work Health & Safety (WHS)

Is it true that mums and dads were the first to return to work after working from home during the COVID measures?

Working from home and returning to work raises many issues for employers and employees. Productivity may have increased with some working from home but there are health & safety, administration, security and staff morale issues to consider, to mention just a few.

There is a great article on the topic in this month's Law Society Journal.

Parenting & divorce podcasts

Parenting & divorce podcasts

If you're on the road a fair bit like many of us you might already listen to podcasts. A couple of podcasts to look for include:-

- Parental as anything with Maggie Dent - talks with parenting experts and has lots of practical advice for parents. It's an ABC Radio podcast.

- The good divorce - if you are contemplating divorce, in the middle of one or getting over one. ABC Radio National online.

Cemeteries plan could see cost of burials jump by $9,000

"The cost of burials is likely to rise by as much as $9000 under a radical New South Wales Government plan to disband the state's largest faith-based cemetery operators."

(NSW funerals to jump by $9000 by Marilyn Rodrigues Catholic Weekly 25 May 2021)

Elder law information

Elder law information

Catherine Henry Lawyers in Newcastle have put together some useful information on elder law. They have a blog podcasts and a newsletter they will email to you.

(Elder law blog with case examples)

(Catherine Henry Lawyers elder law page)

Charities & not-for-profits - What's happening?

Brigid Cowling in an article for the Tax Institute pointed out some challenges.

(See TaxVine newsletter 23 April 2021)

HomeBuilder extended

HomeBuilder extended

"The Federal Government is extending the construction commencement requirement for the successful HomeBuilder program from six months to 18 months.

The extension will only apply to existing applicants and provide an additional 12 months to commence construction from the date that the building contract was signed. All applicants who signed contracts during the HomeBuilder eligibility period between 4 June 2020 and 31 March 2021 will have this extension applied to them."

(NSW Law Society)

Funeral costs under review

Funeral costs under review

The NSW The Independent Pricing and Regulatory Tribunal has released a draft report and is asking for feedback on its draft recommendations until May 14.

The Sydney Morning Herald reported that "most people in NSW do have access to a choice of affordable providers and a range of funeral services" but "grieving families surveyed said they need clearer information - especially around pricing - often finding the process confusing."

(SMH article - NSW funeral industry under fire over costs)

National Disability Insurance Scheme (NDIS)

Catherine Henry Lawyers in Newcastle have put together a useful information guide to the NDIS. They also have other useful information on their website.

(NDIS information eBook by Catherine Henry Lawyers)

(Catherine Henry Laywers blog)

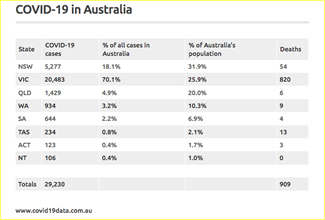

COVID-19 in Australia infogram

Covid-19 stimulus is coming to an end - what now?

Covid-19 stimulus is coming to an end - what now?

Business was disrupted by Covid-19 and for many businesses, how they operate will have changed forever. Some stimulus and reliefs have already finished while others will end on 31 March 2021.

Now is a good time to talk with business advisers about the future of your business. It is a good time to be planning, looking at restructuring or other proposals. "Safe harbour" action can also be undertaken by directors but it is important to be pro-active. Act now and not leave these things too late.

(See restructuring overview - Worrells)

(Small business cashflow loan scheme - Findex)

Covid-19 Tax & Safe Work information

Covid-19 Tax & Safe Work information

- Australian Tax Office (ATO) working from home

- ATO Practical Compliance Guideline - PCG 2020/3

- Pandemic Leave Disaster Payment if you live in NSW and can't earn an income because you must self-isolate, quarantine or care for someone due to COVID-19

- Boost to cash flow for employers

- Detailed infrographic on JobKeeper updated

- Technical information on JobKeeper with changes updated

- JobKeeper payment information

- JobKeeper turnover test explanation - Tax Institute TaxVine 1 May 2020

- Safe Work Australia - National Covid-19 safe workplace principles

Links to legal help & information regarding Covid-19

Links to legal help & information regarding Covid-19

- NSW government portal - rules, resources & updates

- Fair Trading NSW

- Legal Aid NSW fact sheets

- LawAccess tele 1300 888 529

- Residential tenants & landlords

- Commercial tenants & landlords leasing principles

- Commercial lease support links

- Bank relief measures for small business

- ACCC information for small business & consumers

- Telephone mediation family law - Early Resolution Assistance (ERA)

- University of Sydney Covid-19 dashboard

Charities Alert Summer 2020/21 by Crowe/Findex Group

Crowe Australiasia has prepared a useful guide for charities and not-for-profit organisations.

(Download Charities Alert: Summer 2020/21)

Australian Economic Outlook

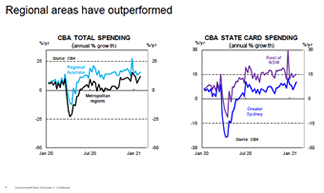

Kristina Clifton, CBA senior economist, presented some interesting slides at a nice breakfast hosted by the CBA on 17 February 2021 at Devil's Hollow Brewery in Dubbo.

(Full presentation by Kristina Clifton - Australian Economic Outlook)

A great resource for children to young adults, parents & schools

Anytime. Any Reason. Call 1800 55 1800

(Respect for yourself and others)

A great resource is the Vincent Studios photographic images collection of photos taken from 1930s to 1970s in Dubbo. There are so many names that you will recognise. You can check through the index of photographs and place an order for photos online.

(Link to Vincent Studios Photographic Collection)

Sale advertising found to be misleading

Sale advertising found to be misleading

Have you ever wondered if shops put up prices before advertising discounts?

Apparently, in July 2020 Kogan advertised a "tax time" discount of 10% after it had increased the prices on hundreds of stock items. Kogan Australia Pty Ltd was fined $350,000 for making false or misleading representations in contravention of the Australian Consumer Law.

That might be small consolation for the customers that thought they were getting bargains?

Tomorrow is Australia Day and the theme for 2021 is 'Reflect. Respect. Celebrate.'

"Australia has a wonderfully rich and diverse population and heritage. Our country is home to the oldest continuous culture on earth with a history reaching back beyond 60,000 years. I think that is something about which all Australians can and should be immensely proud. So too I think we should all be proud of our rich migrant heritage and our cohesive society. These are things to honour, respect and celebrate."

"Australia has a wonderfully rich and diverse population and heritage. Our country is home to the oldest continuous culture on earth with a history reaching back beyond 60,000 years. I think that is something about which all Australians can and should be immensely proud. So too I think we should all be proud of our rich migrant heritage and our cohesive society. These are things to honour, respect and celebrate."

(Juliana Warner, President, the Law Society of NSW)

(2017 Australia Day Lamb Ad Video on YouTube)

Small business insolvency reforms

In 2020 liquidations were down 80%. That sounds good but there is a concern that liquidations could jump up in 2021 when Covid-19 relief measures run out.

The Federal government has introduced legislation to help small business survive the economic impact of Covid-19. A new debt restructing process will be available for companies with liabilities less than $1m. There are other requirements to be met also. Details are not available as yet to determine if it will be the process will be simpler as is intended.

(Federal government fact sheet)

(Article by Darren Vardy of SV Partners 19 January 2021)

We wish you all the best for Christmas and the New Year.

We will close on Wednesday 23 December, 2020 at noon and re-open on Monday 11 January, 2021 at 9.00 am.

Scott Pape (the Barefoot Investor) asks: If I got hit by a bus would my family be able to put everything together?

"Here's the bolt out of the blue: you leave your loved ones with a financial Rubik's cube of frustration. Picture your partner (or parents) sitting alone, distraught and grieving, trying to piece together your financial life. They have no idea how to access your bank accounts, the password to your email and social media, your funeral wishes or even where your will is.

Here's what you can do about it: Spend an afternoon getting everything in one place. At Barefoot we call it the Fearless Folder, and once it's done you lock it away in a secure safe. The feedback I get from people who have done it is that it's Marie Kondo-cathartic to have it all sorted. What's more, it's the final way you'll say "I love you" to your loved ones."

(Scott Pape Here's what could happen in 2021 Newsletter 7 December 2020)

Dubbo bridge options

A recent presentation by Dubbo Regional Council & Balmoral Group included some interesting information about future residential development in Dubbo, current and projected traffic numbers.

Homebuilder extended

Homebuilder extended

The Federal Government is extending the HomeBuilder program from 1 January 2021 to 31 March 2021.

HomeBuilder provides eligible owner-occupiers (including first home buyers) with a grant to build a new home or substantially renovate an existing home. Construction must be contracted to commence within three months of the contract date.

(Homebuilder factsheet) (Homebuilder Frequently Asked Questions)

(First home buyers boost for 12 months from 1 August 2020)

Stamp duties v land taxes? Summary of NSW State budget

Stamp duties v land taxes? Summary of NSW State budget

Pitcher Partners have prepared a concise summary of the latest NSW State budget including reference to $1,500 digital vouchers, $100 out & about vouchers and reform of stamp duty and land tax.

(See Article by Lawrence Dujmovic of Pitcher Partners 17 November 2020)

Replacing alert & alarmed with informed & engaged

In these challenging and uncertain times, could the answer be to: look up?

In an engagingly presented summary, neuroscientist Dr Fiona Kerr, believes that a simple technique can improve our mood, boost our brainpower and help us build our social connections.

(See The Art and Science of Looking Up by Dr Fiona King & Lekki Maze 66 pages)

"This year despite the change in date and the circumstances of 2020, NAIDOC Week is once again bringing us together to celebrate the histories, cultures and achievements of Aboriginal and Torres Strait Islander peoples." (Reconciliation Australia)

Adopted children's birth certificates

From 16 November 2020 people adopted in NSW may use for identification a post-adoption birth certificate that records the child's adoptive parents without reference to the parents at birth; or an intergrated birth certificate that includes information about the parents at birth as well as adoptive parents.

(Fact sheet) (FaCS - Adoption) (Registry of Births Deaths & Marriages)

City Futures Research

City Futures Research

The City Futures Research Centre, an initiative of the UNSW Built Environment faculty, brings together a variety of contemporary research and resources about urban design. Previous City Futures research found 72-85% of owners corporations had identified major defects in their buildings.

- Cracks in the compact city: defects in strata.

- COVID-19 Australian Property Market Dashboard

- Urban well-being resources & links

- Who lives in apartments?

- 2020 Australian & NZ strata insights

Remote working - Employment issues - Good advice for any time

"Putting to one side an employer's legal obligations, employers have an important role to play in this crisis [COVID-19]. For many people, the only normal is their employment ... employers are in a unique situation, they can assist their employees to get through this and not because they have a legal obligation to do that, you know, we are all in this together and it's just the right thing to do."

"My human advice, not necessarily my legal advice, employers should do all they can to support their employees and show compassion and empathy and be flexible and adaptable at this time as best they can."

(Felicity Edwards of Sparke Helmore LawCover Risk on Air podcast)

Life & Beyond - Instructions for family after death

"Don't 'check out' and leave your family wondering! You write it, they read it, you get you what YOU want"

"Lyndsay Lowe produced the first edition of Life & Beyond in 1998 when she was managing her own business in Dubbo. After selling numerous copies and taking on board suggestions from friends and people who purchased the book, the second print run was produced in 2002. A third print run with additional online information has now sold and the most recent edition includes Family History and space for your DNA details."

Cultural awareness about the languages of the world

I am from Australia but the language I speak is not called Australian. Someone from India does not speak Indian. Click here for a link to a map of some of the languages spoken in the countries near Australia.

Click here for some general information about documents signed by a notary public.

Homebuilder Federal government economic response

Homebuilder Federal government economic response

HomeBuilder provides eligible owner-occupiers (including first home buyers) with a grant of $25,000 to build a new home or substantially renovate an existing home. Construction must be contracted to commence within three months of the contract date.

(Homebuilder factsheet) (Homebuilder Frequently Asked Questions)

(First home buyers boost for 12 months from 1 August 2020)

The Walking Dead? Zombies amongst us? What to do?

The Walking Dead? Zombies amongst us? What to do?

As JobKeeper and other COVID-19 measures wind down we are likely to see more business closures.

"We'll have to confront the reality that there are firms in Australia that are no longer viable because of the pandemic and they will need to be wound up…so there will be insolvencies. There will be bankruptcies. There will be some businesses that will not recover. That's the harsh reality of an economic downturn that's the worst in 100 years". (Philip Lowe RBA Governor)

(See article by Joshua Robb of SV Partners Newcastle)

Stymie web app to disrupt the cycle of bystanding at school

Stymie web app to disrupt the cycle of bystanding at school

"In 87% of cases of bullying and harm, there are bystanders present. While some people may feel comfortable initiating conversations about harm with others, many don't."

"Stymie allows bystanders to remain anonymous, giving them the courage to overcome the fears and social pressures that prevent them from speaking up. It also relieves feelings of helplessness for those who want to help their peers but don't quite know how."

"Stymie is a web application, meaning it can be accessed via any internet browser; nothing needs to be downloaded from a website or store."

Reports should also be made to app providers. It is also a Commonwealth criminal offence to use a carriage service to menace harass or cause offence.

RU OK? Day - Thursday 10 September

Click here for information about helplines and mental health services that are available.

Great RU OK? resources from University of NSW

Click here for Elephant in transit video.

Jersey Day 4 September 2020 supporting organ & tissue donation

Jersey Day 4 September 2020 supporting organ & tissue donation

The idea is to wear on the day your favourite sporting jersey to show support for the Donate Life network and have conversations about the importance of organ & tissue donation. Jersey Day is inspired by Nathan Gremmo, a young man who died in an accident in 2015. Nathan's family chose to donate and give the gift of life to others.

(Visit Donate Life) (Visit Jersey Day)

Crime across most of NSW has remained stable or fallen in the two years to June 2020

"...crime patterns were significantly interrupted in April 2020 by the pandemic response. In June 2020, recorded incidents of break ins, car theft and retail theft were still considerably lower than the same period in 2019."

"The only major exception to this is sexual assault which rose 9.4% year-on-year to June 2020. A similar upward trend was reported in the previous quarterly report."

(See BOSCAR - NSW Bureau of Crime Statistics and Research)

Lawyer's sexual harassment results in damages claim

An employer's appeal against a sexual harassment finding was recently dismissed. The employee, a lawyer, was awarded $120,000 general damages plus $50,000 aggravated damages against her employer under the Commonwealth Sex Discrimination Act 1984.

A judge on the appeal posed the question, "What is the ruin of a person's life worth?" The trial judge had referred to the employer's "despicable acts". The appeal judge also referred to the employer's "gross dereliction of his professional duty" as a lawyer.

(Hughes Lawyers v Hill [2020] FCAFC 126)

JobKeeper 2.0 - details & infographic from Tax Institute

JobKeeper 2.0 - details & infographic from Tax Institute

Technical information on JobKeeper with recent changes to 28 March 2021 by Robyn Jacobson from the Tax Instute (click here)

Detailed infrographic on JobKeeper with recent changes to 28 March 2021 (click here)

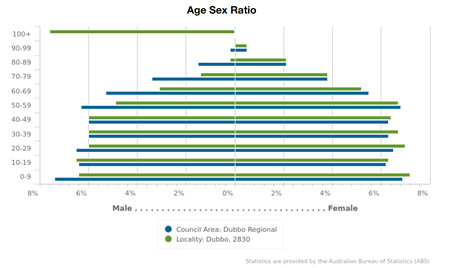

Dubbo Region data centre statistics

From the Dubbo Regional Council website some interesting statistical information about the Dubbo Region is readily available. For instance, this chart of the ages & sex of the population as at June 2020. Not quite sure what's going on with the 100+ age group though? (Dubbo Region data centre)

Amica - as in "amicable" - online service for separating couples

Amica - as in "amicable" - online service for separating couples

The Attorney-General announced on 30 June 2020 the Amica online service, "Suitable for couples whose relationship is relatively amicable, the new 'amica' tool enables users to negotiate and communicate online with their former partner at their own pace, in their own time and in their own space."

"amica uses artificial intelligence (AI) technology to suggest the split of assets, taking into account: the couple's particular circumstances; the kinds of agreements reached by couples in similar situations; and how courts generally handle disputes of the same nature."

The amica site provides lots of free information and links about family law. The dispute resolution feature is free until 1 January 2021 when fees of between $165 and $440 per couple will be payable.

Isolated elderly and vulnerable

Isolated elderly and vulnerable

A recent law journal article asks, "Has isolating seniors from the virus exposed them to the rising scourge of elder abuse?"

"Just as the lockdown spiked fears of rises in domestic violence, experts worry that elder abuse has increased in recent months. Strict isolation orders were designed to protect the elderly during COVID-19. But at what price?"

Wondered what family mediation is about? Mediation videos

Below are links to a couple of videos about family law mediation. The cinematography and directing will not win any Oscars. Nor will the actor who was called in at the last moment because the films budget did not extend to a proper actor.

(Family Dispute Resolution mediation explanation)

(Family Dispute Resolution mediation parenting information)

Acknowledgement of the Traditional Owners of the Land

We acknowledge the traditional owners of country throughout Australia and recognise the continuing connection to lands, waters and communities. We pay our respect to Aboriginal and Torres Strait Islander cultures; and to Elders both past and present.

Annual General Meeting (AGM) & company signing changes for Covid-19

For the next six months it will be possible for companies to hold their AGMs online rather than in a large group face-to-face. This will help many not-for-profit organisations that are public companies limited by guarantee.

Notices of the AGM may be sent by email and a quorum can be achieved by online attendance. Participants must be given an opportunity to ask questions and voting will be by a poll, not a show of hands.

The changes made under the Federal governments instrument making power during Covid-19 also allow companies to sign documents electronically. NSW has also legislated to facilitate the witnessing of documents during Covid-19.

(Federal Treasurer's announcement)

(Details of legislative determination)

Covid-19 legislation - Firearms compliance

Legislation has been passed to allow some exemptions to compliance with the restrictions attached to licensed firearms. For instance, in relation to sporting club attendance. See legislation.

Working from home? What about some guidelines?

Email policies are likely to already be in place however just a few things to think about when developing a working-from-home policy, include:-

- The security of client files & business documents. If paper documents, how will they be transported and stored at home?

- The use of screen locking, logins & passwords. For instance, should logins & passwords be saved on the home computer?

- Maintainence of privacy & confidentiality. How will loud conversations be kept private? Will documents be printed out at home and how will documents at home be thrown out?

- Work safety must still be kept in mind. Be aware of ergonomics in the home office and wellbeing while working at home. For instance, how to debrief after a stressful telephone work call at home?

- Video conferencing policies. Online there are many examples of guidelines for video conferencing, particularly, from universities and other organisations that have been using it for many years. Many guidelines recommend good practices as well as good etiquette. Some internet video providers can record the conference. Has this been agreed to by the participants?

- Insurance coverage for personnel and business property taken home.

This is all the more complicated by most homes not having facilities for mum , dad and students all working from home.

Landlords & tenants - Now is the time to start talking

Landlords & tenants - Now is the time to start talking

With the closure of many shop fronts, how will the tenants pay their rent and the landlords meet their mortgage payments? Is it better for tenants to get out of the lease now? Is it better to have a tenant in occupation ready to reopen rather than vacant premises that have to be relet?

Rent can be varied by agreement but most leases do not allow rent to abate unless the premises are destroyed. Leases for a fixed term usually cannot be ended early without penalty. Sometimes a party can be excused from a contractual obligation because of frustration but this is a complicated legal principle and difficult to establish.

Corona virus/Covid-19 health protocols

We space out our appointments and do not have large numbers of people gathering in our office. Be assured that we have always maintained healthy cough, sneeze and hand hygiene practices.

If you are concerned about going out or coming into our office you may of course telephone or email us. We can also use Facetime or Skype video if you would prefer.

We will continue to support local businesses as much as possible in what will be difficult times ahead for many businesses.

(See WHO Healthy hand washing diagram)

(ABC Radio health news & Coronavirus updates ABC News)

"But you just take more than you give"

Recent stories of panic buying in the shops bring to mind the lyrics of the classic song by Moving Pictures, What about me?. Behaviour totally opposite to the kind of behaviour we saw during and after the fires?

Two articles about Corona virus and travel insurance are available at: COVID-19 & Travel Insurance & This event has been cancelled - COVID-19 is in town.

Mental health & well-being resources

Many are concerned about depression in those experiencing drought; post traumatic stress from those who experienced the recent fires; and now anxiety caused by panic about the Corona/Corvid-19 virus. Not only for those directly affected but those indirectly affected too. This can put a strain on our relationships and our children.

Help is available. Lifeline (1800 085 062) and Centacare (02 6884 5889) have good services. Most employers have Employee Assistance Programs (EAP) as do some unions. Many professional bodies also provide assistance e.g. Law Society of NSW, LawCover The Resilient Lawyer by Robyn Brady, Wellbeing at the Bar.

GIVIT - Goods for Good Causes

GIVIT - Goods for Good Causes

A positive to come out of the drought and fires is the humanity shown by people toward others.

Many people are donating their time and money to help others, usually total strangers.

If you would like to help more directly with specific items needed GIVIT might be worth considering.

Wages underpayment - What to do?

Woolworths, Coles, restaurant owners and others are all in the news for underpaying staff. "Market leaders in staff underpayment" as joked by Shaun Micallef in MAD AS HELL on ABC TV.

If you are wondering as a worker what you can do, Jenna Price in an article in the Sydney Morning Herald had a few tips, along the following lines:-

- check your award for pay rates (a copy of the award should be available at work or ask your manager or go online to the Fair Work Ombudsman)

- from the start maintain your own record of your hours worked, starting and finishing times

- check you payslips against your records and the pay rates of other workers

- check how much super is being paid for you on MyGov

- keep your pay records for many years

If your employer cannot pay you properly and in a timely manner, report it to the Fair Work Ombudsman and think seriously about whether it is an employer you want to be working for.

The Federal government has a Fair Entitlements Guarantee (FEG) previously referred to as the General Employment Entitlements & Redundancy Scheme (GEERS) but this is a last resort in the event of bankruptcy or a company liquidation.

Bushfire donations - Are they tax deductible?

"Donations made to bushfire appeals will only be tax deductible where made to a Deductible Gift Recipient (DGR). A DGR is a body recognised by the ATO to receive tax deductible donations."

"The National Bushfire Recovery Agency has a full list of charities with DGR status that have established appeals. A DGR should provide a receipt of the amount paid, its identification number and a statement that the donation is tax deductible."

(Leo Hollestelle Tax Specialist & Accountant)

Elder abuse legal aid available

Elder abuse legal aid available

Legal Aid NSW has reviewed its client eligibility policies for access to legal services for people who are experiencing or at risk of elder abuse. As a result the means test, family law and civil law policies have been amended.

Legal Aid NSW Dubbo tele (02) 6885 4233 Client Eligibility Unit (02) 9219 5701 LawAccess NSW (free legal helpline) 1300 888 529

ATO drought & bushfire assistance

The Australian Tax Office (ATO) has a drought hotline to call if you require support due to the drought.

The ATO has also said it will provide support for those affected by the bushfires. This includes assistance with tax matters and time to lodge Business Activity Statements (BAS).

(Hotline 1800 806 218 & ATO website: Dealing with disasters)

Celeste Barber's bushfire appeal - What does it have to do with trust law?

Trusts arise in a number of ways. Commonly by will but they can be created during our lives, for instance, family discretionary trusts used for business and unit trusts. Superannuation funds are a particular kind of trust.

Trusts are established for a particular purpose and objects set out in a trust deed or will. A trustee you can only use the trust funds for the purposes of the trust. As a trustee you must also avoid conflicts of your own interest with those of the trust.

Celeste Barber's well-meaning bushfire fundraising appears to have encountered the limits of a trustee's powers. The fundraising clearly asked for donations to the RFS Trust, which will have limited ways of spending the money according to its trust deed. Some donors may have thought their donations could have been used in other ways as well.

(ABC News article 15 January 2020)

Apologies for problems with our telephone lines

Apologies for problems with our telephone lines

For a few days we have been experiencing problems with our incoming telephone lines. To make it worse it seems to be an intermittent problem. We are working on rectifying the problem as soon as possible.

If you have problems calling us please send us an email and we can call or email you back.

We apologise for any inconvenience caused.

Reverse mortgage issues in times of low interest rates

Reverse mortgage issues in times of low interest rates

In times of low interest rates you would think low interest rates were good for reverse mortgages. Noel Whittaker explains reverse mortgages as:

"... the homeowner borrows a fixed sum and makes no repayments of principal or interest. The downside is that when compounding kicks in, the debt grows at a faster and faster rate."

He pointed out in a recent article in the Sydney Morning Herald that there is a flaw in reverse mortgages in times of low interest rates. Some lenders have fixed the interest rate on the reverse mortgage so it is more expensive to get out of those older loans now.

(Releasing home equity a financial health hazard by Noel Whittaker SMH Money 11 December 2019)

We wish you all the best for Christmas and the New Year.

We will close on Friday 20 December, 2019 at noon and re-open on Monday 6 January, 2020 at 9.00 am.

Stay Smart Online & spread the word

Stay Smart Online & spread the word

This Australian government site provides information to protect yourself online at work and home.

Stay Smart Online provides simple, easy to understand advice on how to protect yourself online, as well as up-to-date information on the latest online threats and how to respond.

Bullying came back to haunt employer 15 years later

The reperucussions of bullying cannot be overstated.

Recently a 52 year old man suffering from a range of psychiatric conditions including PTSD and depression successfully sued his employer. He claimed that his condition was materially caused by the bullying and harassment he experienced at the hands of his manager when he was employed between 2003 and 2004.

The plaintiff sought common law damages, as limited by the Workers Compensation Act 1987 (NSW). In particular, he claimed damages for past lost wages and for the future earnings up to the date on which he would have been entitled to retire, namely 20 February 2034. He was awarded $1,394,421.91 plus interest and costs.

(Ward v Allianz Australia Services Pty Ltd [2019] NSWDC 293)

Adult children contesting a parent's will?

A recent Supreme Court Court of Appeal decision contains some interesting comments. The Supreme Court judge that initially heard the case, in dismissing the claim by an adult son, had said,

"It may be common for parents to leave their estates to their adult children – some of whom receive a happy windfall in middle age – but absent special circumstances, there is no legal or moral justification for an able-bodied adult son clinging to a sense of entitlement that he will necessarily benefit from his parent's estate."

"There have been numerous decisions of this court in recent years dismissing claims by adult sons and daughters. Many of these cases, like this one, are conducted on a speculative basis pursuant to a conditional costs agreement. Such cases sometimes unnecessarily fuel the expectations of claimants, ultimately causing more hardship and heartache. Too often they waste the resources of the court and the money of the litigants. The growing frequency of these cases, and the speculative basis on which many are conducted, is a cause for concern."

"Applications are filed in the Supreme Court's Family Provision List at an average rate of about 80 per month."

The Court of Appeal held that the primary judge's critisms were well-founded and although the principles applied by the judge were not applicable to the case before him the judge's conclusion "shorn of rhetoric" was correct.

(Olsen v Olsen [2019] NSWCA 278)

Australian Financial Complaints Authority (AFCA)

Since 2018 the Australian Financial Complaints Authority (AFCA) has had an expanded role with regard to complaints about credit facilities and other services.

The AFCA provides a free service. If a complaint cannot be resolved with a financial firm there is a compensation scheme of last resort. Complaints can be made by small business and primary producers.

Complaints going back to 1 January 2008 may still be made but the window closes on 30 June 2020.

(AFCA website: www.afca.org.au Tele: 1800 931 678 Email: info@afca.org.au)

Working holiday makers - Some are residents, some are not for backpacker tax

A recent case held that a British citizen (Ms Addy) who worked and lived in Sydney was an Australian tax resident during that time. This contrasted with another recent case of a US national (Ms Stockton) who was itinerant and travelled widely while she did some work. She was held not to be an Australian tax resident.

The significance is for the backpacker tax. The first $37,000 of "working holiday taxable income" is taxed at 15% and then the balance is taxed at the standard rates applicable to tax residents.

A tax treaty with the UK requires Australia not to discriminate against a UK tax payer to impose on them a more burdensome tax than Australian taxpayers would be subject to in the same circumstances. As a result Ms Addy did not have to pay backpacker tax rates.

Despite newspaper headlines about the effect on the budget, the Australian Tax Office (ATO) says that most working holiday makers would be liable to pay the backpacker tax. That is because most working holiday makers are not likely to be tax residents, i.e. there will be many more Ms Stocktons than Ms Addys.

Changes needed for home owners & subcontractors

Changes needed for home owners & subcontractors

Peter Merity, a Sydney solicitor specializing in building and construction, proposes the following to protect homeowners and subcontractors:-

- Require unit developers to retain ownership of 25% of the units (by value) in the building for 6 years subject to a charge to secure payment for the rectification of defects.

- Give subcontractors the right to a charge over land on which they have performed building work.

- A compulsory standard form of home building contract for ordinary low-rise residential constructions.

(Peter Merity Building and Construction Lawyers)

Mental health & the Mental Health Act

Catherine Henry Lawyers at Newcastle have prepared some useful information about the Mental Health Act 2007 (NSW). How does a patient get admitted to hospital as an involuntary patient? What is the role of a primary care giver? Some recent cases.

(Link to information provided by Catherine Henry Lawyers Newcastle)

Small business owners are ageing

Kate Carnell, the Australian Small Business and Family Enterprise Ombudsman, has reported that 61% of employing small business owners are approaching retirement age. She said,

"The small business landscape will be transformed over the coming years with a significant number of older small business owners expected to retire, sell or move on." Ms Carnell said.

Link to Australian Securities & Investment Corpation (ASIC) resouces for small business

Link to Australian Tax Office (ATO) resources for small business

Drought loans & grants summary

The NSW Law Society is providing a grant of $50,000 to the Rural Financial Counselling Service NSW Central Region to fund legal assistance for farmers and people in rural communities affected by the drought. Farmers and members of rural communities impacted by the drought will be able to apply for grants of up to $1,200 per individual to pay for legal advice through the confidential counselling service.

The Rural Assistance Authority (RAA) has prepared a summary of the farm loans and grants a available as at 23 September 2019.

(Loans & grants summary RAA 23 September 2019)

Hospitality businesses fail faster than any other

Hospitality businesses fail faster than any other

"In an environment of high rents, labour costs and competition, this is truly a difficult time for those in the hospitality industry. It almost feels commonplace to hear of another established restaurant closing, hospitality staff being underpaid or a disgruntled franchisee upset with the franchising system. Whether it be a fine dining eatery like Woodland House in Melbourne, a culinary institution like Longrain in Sydney or a long time family run business like Fresh N Wild Fish in Portside, it appears no type of hospitality business is immune to the overwhelming economic factors described above."

(see full article Trends in the Hospitality Industry by Shumit Banerjee SV Partners Sydney)

Downsizer (upsizer or same sizer) incentive

The incentive intended for older people to downsize allows each owner to use up to $300,000 of the proceeds from the sale of the family home to go into super.

There are a number of conditions to be met (e.g. age, period of ownership of principal place of residence, contirbution deadline) but as long as they are met it doesn't seem to matter whether you are actually moving into a smaller home or not.

(Read article by Bob Deutsch Senior Tax Counsel The Tax Institute)

"Be nice to your children. They pick your nursing home."

Currently roughly 3.6 Australians work for every Australian retiree. By 2040, the Australian ratio is expected to drop to 2.6.

What can we do? Do more with superannuation? How do we get younger skilled workers to work longer? Lower interest rates may not be helping retirees.

(UN World Population Prospects 2019: Highlights)

Employees must watch what they say, even anonymously

Employees must watch what they say, even anonymously

The recent High Court case of Comcare v Banerji [2019] HCA 23 in line with numerous other cases upheld the right of an employer to take issue with an employee's public statements that could damage the employer.

Over six years a public servant had sent about 9,000 tweets many of which were critical of her department, the government and opposition. The the public service code of conduct requires an employee to uphold the good reputation of the public service and values being apolitical, impartial and professional. Her termination for breach of the public service code of conduct was held to be reasonable.

It did not matter that a tweeter's identity may not be known but it was noted by the court that when posting things on social media people "shoud assume that at some point his or her identity and the nature of his or her employment will be revealed."

"... like an employee in the private sector, a public sector employee cannot contravene the behavioural expectations of their employer and expect immunity under the guise of exercising freedom of speech. The employer's reasonable and lawful instructions about an employee's conduct, typically expressed in the form of a Code of Conduct and associated social media policy, remain paramount - for so long as the employee and employer choose to remain in an employement relationship." (Public Servants all atwitter: HCA has its say on "free speech" by Jack de Flamingh & Daniel Argyris NSW Law Society Journal September 2019)

NRMA Free2go roadside assistance for young people

Our first car or our friend's first car are not always the most reliable vehicles. A great idea so that young people are not stranded is NRMA's Free2go.

Free2go is roadside assistance for young people whether they are driving or not and whether they own the car or not. It is free for the first two years for 16 year olds and free for one year for drivers 17 to 20 years of age.

Surviving in business - Making it to 10 years

On a similar theme to the next item. A couple of take-aways from a talk by Worrells this week to local accountants & solicitors:-

- How tough it is in business at the present time;

- Systems, people, marketing & finance are critical components of a business; and

- Keep on top of cash flows and provisions.

(Worrells Solvency & Forensic Accountants)

The real costs of running an independent restaurant

The real costs of running an independent restaurant

"You think restaurants are a licence to print money? That is far from the truth," according to Attila Yilmaz the owner-chef of Pazar Food Collective in Canterbury Sydney (in Sydney Morning Herald Good Food Milk Crate 13 August 2019)

Banking Royal commission & farm debt

The Hayne Royal Commission recommended amongst other things that a national farm debt mediation scheme be established. At present each State has it's own scheme.

The Federal government says that it supports mediation occurring soon after a loan becomes distressed and not as a last measure prior to the lender taking enforcement action.

When dealing with distressed agricultural loans, the Royal commission also recommended that banks should:-

- ensure that those loans are managed by experienced agricultural bankers;

- offer farm debt mediation as soon as a loan is classified as distressed;

- manage every distressed loan on the footing that working out will be the best outcome for bank and borrower, and enforcement the worst;

- recognise that appointment of receivers or any other form of external administrator is a remedy of last resort; and

- cease charging default interest when there is no realistic prospect of recovering the amount charged.

Have a say in community projects in our area

Have a say in community projects in our area

The NSW government makes funding available to community organisations through the My Community Project. Using your Services NSW account login you can vote for projects you would like to see funded in our area.

For current projects voting closes on Thursday 15 August 2019. You need to vote for three things. My first choice was the hub for the homeless.

Vote for My Community Project at https://mycommunityproject.service.nsw.gov.au

Cleaning and courier businesses - More forms for the tax office

Cleaning and courier businesses - More forms for the tax office

Businesses providing cleaning and courier services must soon lodge a Taxable Payments Annual Report (TPAR). Due by 28 August 2019 the report is for payments made to contractors for the services they provided on the business's behalf between 1 July 2018 and 30 June 2019.

(See the Australian Tax Office (ATO) site for more information)

Rental properties: What's deductible and what's not for repairs?

Rental properties: What's deductible and what's not for repairs?

The Tax Institute has produced a helpful info graphic (see here).

Selling or giving away a cat or dog?

Services NSW advises that from 1 July 2019, people advertising kittens, cats, puppies or dogs for sale or to give away in NSW will need to include in advertisements an identification number (i.e. microchip, breeder or organisation No.). More information.

Elder abuse awareness

Elder abuse awareness

Elder abuse can be physical, emotional or financial. In situations where there is an expectation of trust this can be very distressing for the elderly. Sometimes third parties ingratiate themselves with the older person for financial advantage and they can easily fall victims to scams.

We need to be aware of the issues and discuss it openly. A useful resource has been produced by Catherine Henry Lawyers. See Catherine Henry Lawyers article. See also Older people legal topics by Catherine Henry Lawyers. See also Elder Abuse Help page.

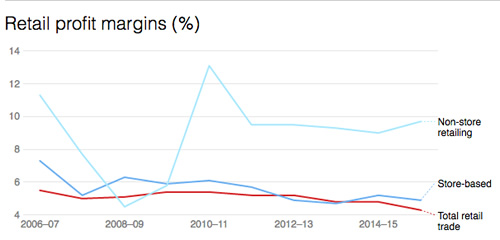

The future of retail shopping

This graph of retail profit margins from The Conversation 4 September 2017 is old news now but illustrates how tough it has been in retail for awhile now.

Dr Jason Pallant of Swinburne University Melbourne was interviewed on ABC Radio Central West on 5 June 2019 by Myf Warhurst about shopping centres becoming more "experiential" and the future of retail shopping. (Listen to McDonald's restaurants in Austria will function as US embassies)

Dr Pallant thinks that shopping centres need to become the "third place" to go after home and work. They need to provide a range of services and facilities that are useful and meaningful to us not just shops. For example, they may include restaurants, medical services, playgrounds and be adjacent to sporting facilities.

A Long Walk to Treatment

In October 2018, as part of the Fair Treatment campaign, 100 supporters walked the 500,000 steps from Dubbo to Sydney to highlight the distance a person in regional NSW may have to travel to reach the drug treatment they need. This Long Walk to Treatment has been made into a powerful documentary, Half a Million Steps, highlighting the personal stories behind the movement for a reform on drugs and the fair treatment of all people.

A premiere screening of Half a Million Steps will be held on Friday 14 June 2019 (6pm arrival for 7pm screening) at the Dubbo RSL 178 Brisbane Street Dubbo. Bookings can be made at: tinyurl.com/DubboPremiere

Tax time is coming up - work related expenses & data matching

Tax time is coming up - work related expenses & data matching

The Australian Tax Office (ATO) says that many employees are entitled to claim deductions in their tax returns for work related expenses but there are some common misconceptions about exactly what can be claimed.

To claim work related expenses employees must: have spent the money themselves and not been reimbursed; ensure the expense is directly related to earning their income; and have a record to prove their claim. The ATO closely monitors claims for unusual patterns related to specific employment.

The ATO matches data from banks and other government agencies against it's own information to identify where people and businesses may not be reporting all their income. The ATO looks for: interest and dividend income; employment income; government payments; the disposal of shares and property; government grants and payment; payments made to contactors; and distributions from partnerships, trusts and managed funds.

(For more information on work related deductions see ATO site)

Disappointing survey of lawyers

Disappointing survey of lawyers

An international survey has revealed extensive bullying and harassment in the legal profession. Unfortunately, it seems that much of it goes unreported.

Michael Tidball CEO of the Law Society of NSW says, "This is a clarion wake-up call for the legal profession, about a problem we need to address."