Older news items 2016 to 2018

We wish you all the best for Christmas and the New Year.

We will close on Friday 21 December, 2018 at noon and re-open on Monday 7 January, 2019 at 9.00 am.

Summer in Australia - its not all at the beach or around the pool

Summer in Australia - its not all at the beach or around the pool

The song lyrics refer to, "sitting on the patio ... the night-time sweats ... this is Australia". With droughts and flooding rains Summer can also bring bushfires and storms. These can wreak havoc for people. For a businesses these events can be devasting too.

Some emergency management ideas are also provided by business.gov.au (see).

Agricultural lending data for 2016-17 and other interesting reading

The Agricultural Lending Data 2016-17 report has been released on the Department of Agriculture and Water Resources website. The data collection for the report was undertaken by the Australian Prudential Regulation Authority (APRA) and includes the generally good 2016 year. The forward to the report says:-

The Agricultural Lending Data 2016-17 report has been released on the Department of Agriculture and Water Resources website. The data collection for the report was undertaken by the Australian Prudential Regulation Authority (APRA) and includes the generally good 2016 year. The forward to the report says:-

"The Agricultural Lending Data 2016–17 report provides proof of the strength of Australian agriculture and the robustness of lending to the sector. In 2016–17 banks had more than $70 billion in lending with the agriculture sector—a strong indicator the finance industry is viewing farming as a long-term profitable investment. During this same period, agricultural production exceeded $60 billion for the first time and farm exports hit $49 billion. Agriculture is in a strong position, but its ongoing success and global competitiveness is contingent on access to capital—from both traditional and non-traditional sources. For its part, the Australian Government supports the use of both sources of capital."

(Agricultural Lending Data 2016-17)

(See also The Current Rural Environment report by Queensland Rural and Industry Development Authority)

Family law - the collision of emotions and commercial reality

An interesting paper on family law property settlement was presented recently by Rishi Wijay for the Tax Institute. The paper was prepared for accountants and provides a useful summary of the family law about property in Australia (although there are some differences in family law in WA). Some of the interesting observations include:-

"One of the odd things about property settlement is that soon after a separation, when emotions are still raw, parties are expected to act in a commercially sensible way regarding the division of their assets."

"Part of our joint role as advisors to separating clients is to help them (respectfully and gently) move past their initial emotional reactions, and to come to terms with some of the unavoidable truths of property settlement. Here are my top four:

- You will not be in the same financial position before and after your divorce.

- No one can give you 100% certainty about how much you will receive in your property settlement.

- While everyone wants to finalise their property settlement immediately, delay is inevitable if parties require the Family Court to decide their case.

- Litigating all the way to final trial is a lengthy and costly process. Pursuing the "principle" must always be weighed against the costs of litigation."

Narcissistic leaders increase litigation

"Newly published research from Stanford University and the University of California at Berkeley finds self-obsessed CEOs are more likely to get their company named as a defendant in lawsuits. And they're not inclined to settle, even when their chance of winning isn't strong, dragging out the time and cost of the suit."

(How narcissistic CEOs put companies at risk by Jeanne Sahadi CNN Business)

Do you deal in property? Property developers may need to register for GST.

The Australian Tax Office (ATO) requires you to register for GST if:-

- The turnover from your property transactions (and other transactions) is more than the $75,000 GST registration threshold (most property sales would be for more than this), and

- Your activities are regarded as an enterprise. Have you been doing up properties regularly and selling them?

If you have to add GST to the sale price of your property the purchaser may not always be able to claim an input credit for the GST they have to pay.

Talk to your accountant about this. More information from the ATO can be found here.

Why is your loan application taking so long?

Why is your loan application taking so long?

"Heightened scrutiny by banks of the financial position of borrowers will be the new order and responsible lending will get a whole lot more responsible. … Those applying for a mortgage will need to outline what they spend on everything from Netflix to nannies and from cigarettes to chardonnay."

"… the inquiry into a borrower's expenses will be particularly granular. It will go well beyond loan repayments and credit card expenses. Customers will be asked to itemise their outlays on everything from cosmetics and clothes, to childcare, gambling, alcohol, and pay-television subscriptions."

(From Netflix to nannies: banks on warpath over every dollar you spend by Elizabeth Knight Sydney Morning Herald 13 November 2018, Judge tears up ASIC-Westpac settlement by Sarah Danckert & Lastest judgment shows why ASIC looks like a Keystone corporate cop by Elizabeth Knight Sydney Morning Herald 14 November 2018)

ATO crypto currency guidelines update

The Australian Taxation Office (ATO) has updated its guidelines on the tax treatment of cryptocurrencies such as Bitcoin, Ethereum & Ripple.

(See the ATO site for more information)

Caring for the elderly with dignity

An article was recently sent to me from a UK an aged care training site. The author identified at least eight factors related to our dignity: choice & control; communication; eating & nutritional care; pain management; personal hygiene; practical assistance; privacy; and social inclusion.

The article gave some practical examples of how to uphold the dignity of the elderly in care:-

- Let people choose their own clothing

- Involve them in decisions relating to their care

- Address the person properly

- Make food look & taste nice

- Respect personal space & possessions

- Handle hygiene activities sensitively

- Promote social activities

- Know how to detect pain

- Have a friendly chat

(9 Ways to help promote dignity in your care home by Liz Burton 28 November 2016)

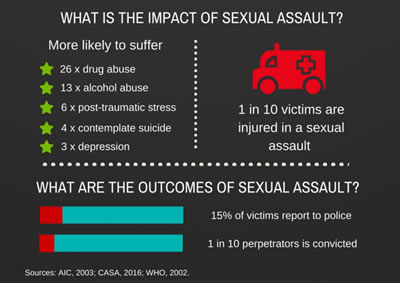

What is the impact of sexual assault?

(Table from article Too Many Loopholes in Boiling Frog by Kate Allman)

Aretha Franklin (1942 - 2018) may have died without a valid will

Aretha Franklin (1942 - 2018) may have died without a valid will

The recently deceased Aretha Franklin was one of the best-selling singers of all time. Described as the queen of soul, her hits included, Respect, Chain of Fools, (You Make Me Feel Like) A Natural Woman and a rendition of Nessun Dorma.

Apparently, Aretha Franklin died without a will to say who she wanted to leave her estate to. It's a reminder of the importance of making a will and how easy it can be to overlook doing it properly.

Managing and preparing for drought

The NSW Department of Primary Industry has released an 8th edition of Managing and Preparing for Drought to help farmers make informed decisions on how to manage the current drought as well any future dry conditions.

This edition includes strategies and actions producers can consider as they deal with the drought, as well as practical information on feeding stock, farm management, sustainable practices and personal and financial wellbeing.

It also includes new information on relevant resources added by the NSW Government and the NSW DPI in recent years, including the online DroughtHub and the Combined Drought Indicator.

(Thanks to Hanna Jaireth at NSW Rural Assistance Authority for circulating this information)

(Managing and Preparing for Drought NSW Dept. Primary Industry 8th edition) Working from home? Claiming home office expenses?

Working from home? Claiming home office expenses?

As more and more of us work from home the Australian Tax Office (ATO) has noticed more incorrect claims for deductions. The ATO provides some information at the links below:-

Building resilience … how to stay healthy at work

Building resilience … how to stay healthy at work

You can help yourself by:-

- Exercising

- Sleeping

- Mindfulness

- Aromatherapy

- Stretching

- Sweating

- Eating well

(Building Resilience - Robyn Bradey - August 2012)

State tribunals may have no jurisdiction if parties are in different States?

In a recent case the High Court held that the NSW Civil & Administrative Tribunal (NCAT) has no jurisdiction in disputes between residents of different States (Burns v Corbett [2018] HCA 15).

If a case cannot be heard in NCAT it may be dealt with in a court however it is likely to be heard at a much greater cost. The result of this court decision could have a wide reaching impact. In many cases, the parties, business or family members live interstate.

NCAT, for instance, has divisions for administrative & equal opportunity; commercial & consumer; occupational; and guardianship.

Tax help for those impacted by drought

Tax help for those impacted by drought

The Australia Tax Office (ATO) offers some help and support with payment plans, extra time to pay and waiver of penalties and interest. It is also important to understand the tax implications of receiving drought relief payments.

ATO help for business - starting out, online & checklists

In recent years the Australian Tax Office (ATO) has been proactive with guidelines, tax tips, reminders and notification if a taxpayer seems out of line with those in the same industry. A few useful ATO links are:-

- Start your business the right way

- Support for a new business

- Small business tax time checklists

- Protect yourself from illegal phoenix companies - who are you working with?

To litigate or not to litigate - that is the question?

To litigate or not to litigate - that is the question?

This not the question posed by Hamlet but recently by Bob Deutsch, Senior Tax Counsel Tax Institute. The article concerned tax litigation but included a number of comments that are applicable to all litigation:

"It never ceases to amaze me how many people appear to be ready, willing, and able to litigate complex commercial matters before a court or tribunal."

"In my experience, taxpayers are poor at assessing the evidence available to them to sustain an argument that they are likely to put to a tribunal or court. Mere assertions are not evidence. Evidence will often require hard documents to sustain an argument. The onus will ordinarily sit with the taxpayer ..."

"Suing ... sounds glamorous but after a few days in a hearing room being quizzed by lawyers the glamour starts to wear off."

"There is nothing wrong with litigating where one has a reasonable chance of success. However, this should be done on the basis of a full and complete understanding of the risks associated with running the litigation ... Sometimes, a regotiated settlement through conciliation is a preferable course. Apart from the problems with litigation ... the sheer stress and strain that it imposes should not be overlooked."

(To litigate or not to litigate - that is the question! by Bob Deutsch Tax Institute TaxVine 20 July 2018)

We need to pull up our socks - Hannah Gadsby: Nanette

We need to pull up our socks - Hannah Gadsby: Nanette

Now on Netflix, this is not the routine standup comedy. It challenges us with viewpoints to behave with more understanding.

Hannah Gadsby contrasts humour with courageous self-revelation. Watching this one-hour video is time well spent. It is moving and powerful.

Teacher awarded six-figure payout after being bullied by school principal

(See Sydney Morning Herald article by Pallavi Singhal 20 September 2017)

If you or someone you know needs help, contact beyondblue on 1300 22 4636, Lifeline on 13 11 44 or Kid's HelpLine on 1800 55 1800

After a successful trial at Manly Courthouse Guide Dogs NSW/ACT has been training companion dogs to help vulnerable and anxious people at courts in Burwood, Campbelltown, Gosford, Goulburn, Lismore, Manly, Nowra, Orange, Sutherland a nd Taree.

nd Taree.

(See Justice NSW media release)

Don't compound a tragedy by not having a will

After the murder of the Brazilian woman Cecilia Haddad, whose body was found in the Lane Cove River, the family have had to search her apartment looking for a will. The woman's father has applied for letters of administration and there is an estranged husband joined as a party to the litigation.

This is a stark reminder of the need for us all to have a will. Our thoughts and prayers go out to those struck by terrible tragedy. The last thing the family needs is complex and costly litigation about the deceased estate.

(Family launch court bid over estate Sydney Morning Herald 3 July 2018)

(Husband wins estate battle Sydney Morning Herald 7 August 2018)

CBA offers drought support to customers

CBA offers drought support to customers

FarmOnline National reported that the CBA's executive general manager of regional and agribusiness banking, Grant Cairns, said:-

"We want to remind our customers of the ongoing support measures we have in place for those who are affected by drought, which should provide some relief during this difficult time."

"Drought support measures may include, depending on circumstances, a range of options, starting with the confidential telephone counselling service, but also including, early FMD withdrawals without penalty; extending business loan term agreements; waiving fees and charges related to business loan restructures, and temporarily freezing business loan repayments."

"He urged the bank's regional and agribusiness customers who may be experiencing financial difficulties as a result of the drought to contact their relationship manager or visit their nearest Commonwealth branch. General drought assistance inquiries could also be made to Commonwealth Bank specialists by telephoning (1300) 772 968."

Businesses avoid being incorrectly charged GST from overseas

GST on low value goods imported into Australia commences from 1 July 2018. Low value imported goods are physical goods – excluding tobacco, tobacco products and alcoholic beverages – with a customs value of A$1,000 or less.

The ATO advises that if you're an Australian GST-registered business, you should not be charged GST when purchasing these goods for your business use, if you provide your supplier with both your Australian business number (ABN) and a statement that you are registered for GST. If you're charged GST incorrectly, you should speak to your supplier about a refund.

The ATO also points out that not all receipts that have GST applied will be tax invoices. To be considered a tax invoice, they will need to contain an ABN. Overseas suppliers may be registered in the simplified GST system and have an ATO reference number (ARN) instead of an ABN.

(Go to Australian Tax Office (ATO) website)

EOFY - Rental property deductions – do's and don'ts

In a recent article Bob Deutsch, Senior tax counsel for The Taxation Institute made these comments in relation to investment properties:-

In a recent article Bob Deutsch, Senior tax counsel for The Taxation Institute made these comments in relation to investment properties:-

"The lion's share of the available tax deductions is generally the interest portion of a mortgage connected with the property... However, other costs can be claimed on an immediate basis provided that they have been incurred by the relevant taxpayer, and they have not been recouped from elsewhere, such as a payment from the tenant."

"Items that can be claimed on this basis include: Advertising for tenants; Bank charges; Body corporate fees and charges / or strata levies; Cleaning costs; Council rates; Depreciation, including certain capital works; Electricity and gas; Gardening and lawn mowing services; Inhouse audio/video service charges; Insurance (including building contents and public liability); Land tax; Letting fees; Pest control services; Property agent's fees and commission; Quantity surveyors' fees; Secretarial and bookkeeping fees; Security patrol fees; Servicing costs, such as the costs of servicing a water heater; Stationery and postage costs; Tax-related expenses; Phone call and rental costs; Water rates."

"Importantly, you cannot claim expenses which are: of a capital nature or of a private nature; related to the acquisition and disposal of the relevant property; body corporate payments to a special purpose fund to pay a particular capital expenditure; expenses which are not actually incurred by the taxpayer, such as water and electricity charges paid by the tenants; expenses that are not related to the rental of a property, such as expenses connected to a holiday home that is rented out for part of the year."

"Some words of caution in relation to particular areas where errors have been made are worthy of emphasis."

"First, a taxpayer who claims a deduction in relation to an investment property must be sure to have receipts to justify the deductions that are being claimed. An absence of such receipts will make life very difficult if an audit calls for proof of the expense. Normally, this will require full substantiation, which means that there needs to be a receipt that is in conformity with the requirements imposed by the Act etc. Although there may in cases be some leeway on this front, reliance should not be placed upon that possibility."

"Secondly, the property must either be rented, or "genuinely available" for rental in the income year for which a deduction is claimed. If a taxpayer uses the property for private purposes, to that extent, the taxpayer cannot claim expenses."

"Importantly in this context, you must demonstrate a clear intention to rent out the property. If no attempt is made to advertise the property, or the rent is set at an unrealistically high non-commercial level such that it could not on any reasonable basis be rented out, the ATO is likely to take the view that there was no intention to rent out the property, and the rental claims will accordingly be disallowed."

"Thirdly, in some situations, rental expenses need to be apportioned. This arises particularly in the context of holiday homes, where either the taxpayer or the taxpayer's family or friends, can stay in the property free of charge for part of the year. To the extent that the expenses relate to that part of the year during which the property is not rented or available for rent, the taxpayer is not entitled to a deduction for costs incurred during those relevant periods."

"Fourthly, to that point, if the property is rented to family or friends for less than arms-length market rental, the ATO may well treat the arrangement as being of a private nature, and could, in all likelihood, only allow the taxpayer to claim sufficient deductions to offset the rent, but not so as to make a tax loss."

"Fifthly, you can no longer claim deductions for travel expenses relating to inspecting, maintaining, or collecting rent for a residential property."

"Sixthly, where residential investment properties were purchased after 9 May 2017, plant and equipment depreciation deductions will be limited only to outlays actually incurred by the investor."

"All these various rules can give rise to some complex outcomes. Where investment property is involved, it can often be worthwhile obtaining the professional advice of a competent tax agent who can reliably advise on what can and cannot be claimed as a deduction."

(The Tax Institute TaxVine 8 June 2018)

Slander of title - neighbour held responsible for damage

Slander of title - neighbour held responsible for damage

When we think of slander or libel we think of legal actions by Rebel Wilson or Alan Jones and defamation of a person. We don't think about slander of real estate or property.

A recent case in the NSW Supreme Court cautions neighbours in disputes not to make untrue statements to potential purchasers of a neighbouring property where those statements might cause the sale to fall through.

Employees must act promptly even when sick to stop bullying

A senior employee alleged that disciplinary proceedings were instigated against her only after she had made a complaint about a senior executive. The employee while unfit for work obtained a stop bullying order against her employer. Despite the employee being unfit for work the employer wanted to continue a workplace investigation and determine an outcome.

The Fair Work Commission (FWC) made interim stop bullying orders, which effectively put a halt to the workplace investigation. To make stop bullying orders the FWC must find that a worker has been bullied at work and there is a risk of it continuing. The employer was not found to be carrying out reasonable management action in a reasonable manner.

(Bayly v Bendigo TAFE [2017] FWC 1886)

"What matters most?" National Palliative Care Week 20 to 26 May 2018

"Australians need to plan ahead for their end-of-life care and discuss it with their loved ones and health professionals," says Australian Medical Association president Dr Gannon.

"Australians need to plan ahead for their end-of-life care and discuss it with their loved ones and health professionals," says Australian Medical Association president Dr Gannon.

"Discussing your end-of-life care plans with your family members helps them to better understand your values, preferences, and goals of care, and will assist them should they have to make decisions on your behalf if you cannot make or communicate your own decisions."

"Thinking about, and planning ahead for, your end-of-life care means you are more likely to receive the type of care and treatments that you actually want, rather than those you do not want."

(Source: Melbourne Catholic and PalliativeCare Australia)

Seniors' rights are in the spotlight this Law Week

"Financial abuse is one of the most prevalent forms of elder abuse, and sadly, it's often perpetrated by family members. In the worst cases, victims are fleeced of their savings by a relative or carer, or may even risk being made homeless."

"A common scenario might involve an older person being pressured to 'go guarantor' on a home loan to help a child or grandchild get a foothold on the property ladder. That's why it's so important for older people to know how to protect themselves, and where to get help if things go wrong,"

(See NSW Minister for Ageing Tanya Davies Media Release 10 May 2018)

National Law Week is coming up

What could be more exciting than a talk on death and dying? Moring tea!

For National Law Week, Macquarie Regional Library at Dubbo will be hosting a free legal talk about paying for funerals and funeral insurance plans.

The talk will be at the Dubbo Library on Tuesday 15 May 2018 at 11:00am and morning tea will be provided. Bookings are required - telephone (02) 6801 4510

Holiday home rentals look to be targeted by ATO

Holiday home rentals look to be targeted by ATO

"The ATO is setting its sights on the large number of mistakes, errors and false claims made by rental property owners who use their own property for personal holidays. The ATO is focusing on taxpayers who claim deductions for holiday homes that are not actually available for rent or available only to friends and family."

"Besides holiday rentals, the ATO is also focused on other times when a property is not rented or genuinely available for rent. It appears some taxpayers claim their property is available for rent, but when the ATO investigates, it is clear they have little intention of renting it out."

(Tax Tips - May 2018 by Leo Hollestelle Tax Specialist & Accountant Mosman)

Stolen Generations Funeral Assistance Fund

In July 2017 the NSW Government established a compensation scheme for Aboriginal children removed up until 1969. The scheme is to run for five years.

The NSW Government also has a fund to contribute $7,000 to the costs of funerals for members of the Stolen Generation.

Information can be obtained by contacting Aboriginal Affairs on 1800 019 998 or Revenue NSW on 1300 135 627.

Australian Tax Office (ATO) practises in the news

The ATO has been in the news quite a bit lately after a Four Corners segment on ABC TV. The Wizard of Id cartoon in the Sydney Morning Herald on Monday 16 April 2018 coincidentally had a strip on the King announcing a simplified tax system.

The ATO has responded to the criticism saying that a small sample has shown only one side of the story (see ATO media release). The Australian Small Business & Family Enterprise Ombudsman has also expressed views (see ASBFEO site). The Tax Institute is suggesting an independent body for examination when there are allegations of inappropriate behaviour by ATO officers (Tax Institute TaxVine 13 April 2018).

Is the appointment of a guardian necessary?

Health professionals must get their patient's consent to treatment. If the patient is incapable of giving consent their "responsible person" can consent for them. The Guardianship Act 1987 specifies who the responsible person is. It is usually a spouse, carer or relative.

It is also possible to appoint an enduring guardian which unlike a power of attorney only comes into effect when you become incapacitated. That is because a guardian makes decisions about your health, care and accommodation, which is not necessary for the guardian to do if you have the capacity to do it for yourself.

The appointment of a guardian is very important if you do not have immediate family that medical professionals can speak to in the event of your incapacity. Consider giving your family directions about organ donation, your medical treatments and life support for you.

(See NCAT Guardianship Division Factsheet - Person responsible)

LIVIN & It ain't weak to speak

LIVIN has been in the local news recently and it is good to see Dubbo locals getting behind it.

LIVIN is about "breaking the stigma of mental health. Connecting, supporting and encouraging one another to talk about their feelings and challenges because "It Ain't Weak to Speak".

If you need help or know someone who might contact Lifeline 13 11 14, Suicide Call Back Service 1300 659 467, MensLine Australia 1300 78 99 78

Real estate information - strata, rural land & asbestos

Some additional information about real estate has been added to our Resources page:-

- Strata living by NSW Fair Trading

- Considerations when buying rural land Dept Primary Industry

- Asbestos information from Dubbo & Orange councils

International Womens Day (IWD) 8 March 2018

International Womens Day (IWD) 8 March 2018

Lets add momemtum to the full recognition of the contribution women make to humanity.

Retirement homes seem a complicated business

The ABC TV show The Checkout had a humourous but informative segment on retirement homes in Series 6 Episode 3 aired on 13 February 2018. An older person will often need someone to help them.

"Despite recent bad publicity and superfical complexity, retirement villages are a simple proposition: they are relatively cheap to move into and stay in, and expensive to leave."

(Retirement villages: a reality check by Richard McCullagh of Patrick McHugh & Co)

Legislation to protect students from sexual predators

On 7 February 2018 the NSW Government introduced legislation to expand special care laws to ensure a teacher who has a sexual relationship with any student at their high school can be convicted and face gaol.

(NSW government media release)

Farm debt mediation - video explanations

The Rural Assistance Authority has recently developed some videos to help farmers and participants understand the mediation process.

(See the link on our Resources page and from there a list of the videos on YouTube)

Revocation of will by reason of same sex marriage

A will is revoked by marriage. This would include any marriage. The issue was raised in a recent article in the NSW Law Society Journal.

Marriage does not revoke a gift in the will to the person married but the rest of the will is likely to be revoked. All couples should have a will and those contemplating marriage or who have married should talk to their solicitors about their wills.

(Wills and estates case notes by Darryl Browne Law Society Journal Issue 40 December 2017)

Bitcoin - the fuss isn't just about the price!

Before Christmas there was an interesting comment in TaxVine by Bob Deutsch, Senior Tax Counsel:-

"With all the fuss going on at the moment about the price of bitcoin hitting $US 11,000, I thought I might use the opportunity to talk a little about the tax implications that might arise from "dealing" in bitcoins. First, a little background. Bitcoin is just one type of cryptocurrency. As at September 2017, there were some 1,100 different cryptocurrencies in existence. Bitcoin was then, and still is, the biggest. As at November 2016, bitcoin had a market capitalisation of $US 11.3 billion.

A cryptocurrency like bitcoin is an unregulated "currency" that is accepted by those in the bitcoin tent, with each transaction being registered on a shared public ledger called a "block chain". All transactions are included in the block chain. Each participant has a bitcoin wallet that tells you how much you still have, just as when you open your real world physical wallet you can see how much currency you still have.

To give some context, in early 2015 a bitcoin was worth $US 300 – so many have made a lot of money - some real; some only paper at this stage. So while the fuss is all about the meteoric price rise, a deeper and more compelling question for us is the fuss about what are the likely tax consequences if you make money from a "dealing" in bitcoin (or any other cryptocurrency for that matter). There are a number of possibilities:-

- If you purchase purely as a speculator (ie because you think you can make money out of it) – it's a revenue asset and any gain is taxed at marginal rates up to 45% as ordinary income.

- If you purchase bitcoin as a business asset with the intention of trading it like inventory, it is trading stock and taxed as such.

- If you purchase for less than $A10,000 and purely for personal consumption (i.e. only to use it to buy products from others in the tent) it is treated as being a personal use asset bought on capital account. Any gain is exempt from tax.

- If you purchase for more than $A10,000 and purely for personal consumption it is treated as being a personal use asset bought on capital account. If held for at least 12 months, only half the capital gain will be included as assessable income.

- If you purchase as a long term investor to hold as capital (which would seem unlikely as no income flows from holding bitcoins) – it is a capital asset and any gain is taxed as a capital gain. In such a case:-

- If you purchase in an individual name - a 50% discount will apply. Hence only half the gain will be taxed at relevant marginal rates

- If you purchase in the name of a superannuation fund - a 33.5% discount will apply. Hence only two thirds of the gain will be taxed at 15%.

Clearly what matters most particularly is the intention at the time of purchase – this should, as with all "investments", be contemporaneously documented in clear and unambiguous terms at the time of purchase. If the intention changes that too should be documented in a similar way. Two further questions follow:-

- Is cryptocurrency a foreign currency for foreign currency realisation purposes and if so what are the implications? and

- What are the GST implications of cryptocurrency dealing?"

(The Tax Institute - TaxVine Member Newsletter 4 - 8 December 2017)

We wish you all the best for Christmas and the New Year.

We will close on Friday 22 December, 2017 at noon and re-open on Monday 8 January, 2018 at 9.00 am.

Embracing diversity - cultural awareness - not just cooking

Embracing diversity - cultural awareness - not just cooking

We are swamped with cook books, cooking shows on TV and websites about cooking and recipes from different cultures. What about our awareness of other aspects of those rich cultures?

SBS TV has been promoting a website to help us understand some aspects of each others cultural heritage. (Cultural competence site)

Sad mismanagment of inappropriate behaviour in workplaces

As more allegations of harassment in workplaces emerge, admittedly some that have been denied, there appears to have been and continues to be a great deal of misbehaviour, or at the very least, inappropriate behaviour occuring in our workplaces.

It is a sad reflection on some of our workplace cultures if we cannot provide a safe and supportive environment. Surely our responses, policies and procedures need to be better than they appear to have been in the past.

We should keep in mind that some of the victims of inappropriate behaviour are our daughters, sisters, wives and mothers as well as friends and co-workers. These behaviours cannot be condoned for any reason. We need to speak up, support others and not be bystanders.

The Mosque Next Door - SBS TV Wednesday nights

I know very little about Islam and I'm not a fan of reality TV but I find the SBS documentary, The Mosque Next Door, a fascinating insight into the lives of some Australian muslims.

I know very little about Islam and I'm not a fan of reality TV but I find the SBS documentary, The Mosque Next Door, a fascinating insight into the lives of some Australian muslims.

The mosque is in a Brisbane suburb, with a multicultural community of young and old, newcomers to Australia and others whose families have lived here for generations. The imam enjoys his cricket and barracks for Australia. Many of the challenges they face seem to be those that all religions face.

(The Mosque Next Door on SBS over a few Wednesday nights)

Wills in a digital age? Unsent text message held to be a will

Wills in a digital age? Unsent text message held to be a will

The Supreme Court in Queensland recently held that an unsent text message operated as a will ( Re Nichol; Nichol v Nichol & Anor [2017] QSC 220). It is not clear whether this case would be followed in NSW.

The case involved two competing applications. One application was for a grant of letters of administration on intestacy (dying without a will) and the other application was for an unsent SMS on the deceased's mobile phone to be admitted to probate as a will.

This would have been complex and expensive litigation, with the costs coming out of the estate. It could have been avoided by making a will with a solicitor.

Please note that the image with this news item is not the SMS in the case and is not an example to follow.

Money smarts for young & old

I was reading the SMH Money section the day after the Melbourne Cup (literally after the horses had bolted). An article "How to teach money smarts" by Nicole Pedersen-McKinnon reminded me of the very useful ASIC MoneySmart site.

I was reading the SMH Money section the day after the Melbourne Cup (literally after the horses had bolted). An article "How to teach money smarts" by Nicole Pedersen-McKinnon reminded me of the very useful ASIC MoneySmart site.

The ASIC MoneySmart site has some great resources, including things to help teach children and young adults about money and finance. There is a link to an interesting video of Scott Pape, a financial expert, interviewing children about money.

(How to teach money smarts by Nicole Pedersen-McKinnon SMH Money section 8 November 2017)

(Scott Pape, financial expert, interviewing children about money)

Sale!

Discounted!

Best prices in town!

We'll beat competitor's price!

There is always someone who can do it cheaper?

Proposed reduction of bankruptcy from 3 years to one year

Legislation has been introduced into Federal parliament to provide that a bankrupt will be automatically discharged at the end of one year rather than 3 years as at present. The discharged bankrupt will still be required to meet contributions from income for at least 2 years, which can be extended for non-compliance.

Insolvency experts believe that these changes reflect a desire by government to encourage enterprise. It is not unusual for some business proprietors to have had a number of bankruptcies*. It may also mean that those with limited assets will be more likely to declare bankruptcy than try to battle on with their debts.

(* For instance, I understand that Trump Entertainment Resorts Inc formerly Trump Hotels & Casino Resorts filed for bankruptcy in the US in 2004, 2009 and 2014)

Digital death - What is it about?

What is the fate of our online social media after our death? Some of the things we have posted online are valuable to us. Who do they belong to after our death?

As more and more of us upload things to social media we need to think about these things. Who owns them? Will the media be frozen or lost? Will it be memorialised but if so, is that what you would wish? Can purchased content be passed on?

Mental health "Glove box" guide in The Land 5 Oct 2017

Grab a copy if you can of The Land newspaper from last week. It has a useful supplement.

The Glove Box Guide to Mental Health is a great resource for everyone with lots of interesting material and contacts.

Bankruptcy - transfer 10 years earlier was clawed back

"A Federal Court decision highlights the attitude that the judiciary takes towards transfers of property that are perceived as being intended to frustrate or evade legitimate creditors, even many years down the track."

"In the case of Turner in his capacity as trustee of the bankrupt estate of Wallace v Wallace [2016] FCCA 963 the court voided a transfer of a bankrupt husband's interest in the family home to his wife - even though that transfer occurred 10 years before his eventual bankruptcy, and there were no clear issues relating to his solvency at that time."

"Nonetheless, the court's conclusion that the property was transferred with the intention of defeating future creditors, based in large part on the fact that Gregory Wallace continued to represent that he retained ownership in the family home, was sufficient to permit a "clawing back" of the transfer."

(SmithHancock Insolveny Newsletter August 2017)

Employees can recover unpaid entitlements directly from directors

"Under the Fair Work Act 2009 (Cth), unpaid employee entitlements can be recovered from the employer and, in appropriate cases, from a director or other knowing participant. A director or other knowing participant will be liable if they were 'involved' in the relevant contraventions in the sense required by s 550 of the Act."

"The recent Federal Circuit Court decision in CFMEU v RGN Mining Services Pty Ltd [2017] FCCA 1546 provides an example of the recovery of unpaid entitlements from an individual director where the corporate employer was in liquidation. In that case the director was ordered to pay not only unpaid award and agreement entitlements, but also contractual entitlements not paid by the employer."

Selling real estate for $750,000 or more?

Don't forget Foreign Residents Withholding Tax (FRWT)

From 1 July 2017 Australian residents selling real estate with a market value of $750,000 or more need to apply for a clearance certificate from the Australian Taxation Office (ATO) to ensure that an amount is not withheld from the sale proceeds. Where a clearance certificate is not provided by the vendor the purchaser must withhold 12.5% of the sale price on settlement and pay it to the ATO.

When this measure was introduced in July 2016 it only applied to sales for $2m and above. With the reduced threshold many more sales are now affected.

(ATO Foreign residents withholding tax factsheet)

(Online application for clearance certificate for Australian residents)

Teacher awarded six-figure payout after being bullied by school principal

Teacher awarded six-figure payout after being bullied by school principal

(See Sydney Morning Herald article by Pallavi Singhal 20 September 2017)

If you or someone you know needs help, contact beyondblue on 1300 22 4636, Lifeline on 13 11 44 or Kid's HelpLine on 1800 55 1800

Over the last 40 years, what has had the biggest impact? CGT, GST or SGL?

"When reflecting on the last 40 years, it occurs to me that there have been four major tax related reforms. In no particular order, these are:

- The introduction of capital gains tax in 1985;

- The introduction of imputation for corporate entities in 1987;

- The introduction of goods and services tax in 2000; and

- The introduction of a compulsory form of superannuation in 1992.

Each of these four measures were critically important and have had a long term and enduring impact on the Australian economy in the ensuing years. If, however one were to select one of these four measures as having perhaps the greatest impact, compulsory superannuation is a standout in that it has been the catalyst for the creation of an investment asset pool in excess of $2.3 trillion as at 30 June 2017.

Where that $2.3 trillion would have gone in the absence of superannuation over the last 25 years is an interesting question to speculate on, but there is no doubt that wherever it may have gone, it would have resulted in a significantly lesser pile of investment assets which Australians can utilise in their retirement years."

(Bob Deutsch, Senior Tax Counsele's Report, CTA TaxVine, The Tax Institute Newsletter 32 - 25 Aug 2017)

Long service leave - a few things to know

The Long Service Leave Act 1955 applies to most employees in NSW. It applies to casuals as well as those who work full-time and part-time. The intention of the legislation is that employees take a a well-earned break not that they receive a money windfall.

Basically, an employee working for the same employer for 10 years is entitled to two months paid leave at their ordinary gross weekly wage. It does not matter that the employees duties have have changed over that time.

If the employer approves breaks from work it does not stop long service leave accruing but the absence may not be counted as part of the period of service for an employer.

If a business is sold and the employee continues to work for the new owner the time with the previous owner and new owner add together for the calculation of the period of service. On the sale of the business an adjustment is usually made with the new owner to allow for this.

An employee has no entitlement to long service leave if they finish before five years. After five years and before working 10 years an employee may still be entitled to a proportion of their long service leave if they resign due to illness, incapacity or pressing domestic or other necessity.

Employees in the construction and mining industries and cleaning contractors may have different entitlements.

For more information see: Long Service Leave guide or go to Industrial Relations NSW or contact the Fair Work Infoline on 13 13 94.

Is the ABC TV show "Utopia" reality TV? Is it satire or a documentary?

Is the ABC TV show "Utopia" reality TV? Is it satire or a documentary?

Q: "When and why did you decide on a career in communications?"

A: "I realised I had a talent for making bold claims unsupported by evidence a few years back when working as a lobbyist for the multi-vitamin industry. Since then I've fallen in love with the time-honoured art of shaping a message, creating talking points, changing topics at will."

(Kitty Flanagan as Rhonda the PR manager for Nation Building Australia)

(See "Spinning around" article "Golden rules of savvy satire" by Debi Enker in SMH Guide 24 July 2017)

Accountant held liable as a third party accessory to client's fair work breaches

Under the Fair Work Act 2009 (Cth) a person who is involved in a contravention of a civil remedy provision can be liable for the contravention as an accessory. Ignorance of the law is no defence.

Last year the Fair Work Ombudsman said, "So far this financial year nearly every matter we have filed in court - 94% in fact - has also roped in an accessory".

There have been a number of cases where individuals have been liable for corporate contraventions e.g. a business manager fined for underpayment breaches; an employment development manager fined for underpayment on a termination notice; a payroll officer fined for underpayment of entitlements; and an OH&S manager fined for changing employees contracts.

However, in a first, in a récent case a third party accounting firm that provided payroll services was held to be liable for a contravention. The firm failed to ensure their MYOB software reflected the current award rates. Instead of making enquiries of their client they deliberately shut their eyes to possible award breaches.

The author of the article referred to below suggests that "in order to minimise exposure to liability as an accessory, third party advisers are encouraged to scrutinise their client's compliance with workplace laws".

(See article by Katrina Seck in Law Society Journal Issue 35 July 2017)

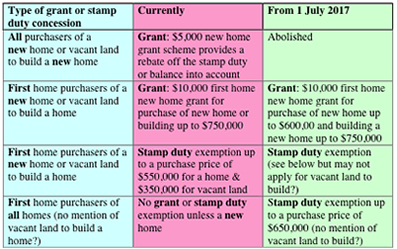

Changes to grants & stamp duty concessions announced by State government

This was a pre-State budget announcement. The details of the changes to the new home and first home grant and stamp duty schemes have yet to be released. Below is a summary which will need to be checked against the actual measures once released.

A couple of things to note at this point is that the new home grant that was available to any purchaser (not just first home buyers) will end on 30 June 2017. From 1 July 2017 first home owners will be entitled to a grant and stamp duty exemption up to certain limits for new or existing homes (which is what applied a few years ago). It was not clear from the announcement if the stamp duty exemption will apply to vacant land purchased to build (it has in previous years).

Check the details of the changes at the Office of State Revenue website. Here.

How does your business compare with others?

How does your business compare with others?

The Australian Taxation Office (ATO) maintains an extensive database of details for businesses across a number of industries compiled from tax returns. The database is updated regularly. Take a look to see if any of the information available is useful to you.

(ATO small business benchmarks)

Randwick Sydney Children's Hospital Gold Appeal

The telethon appeal is on 12 June 2017 and 8 year old Dubbo boy Owen Walkom is the face of the appeal this year.

Imagine that: our "soft skills" will drive our success at work

This was the title of a recent article by Caitlin Fitzsimmons in the SMH. She went on to write about the new book Thank You For Being Late by Thomas Friedman. He believes that soft skills are more important than hard skills.

The article went on to say, "... the emphasis on technical skills is overdone. Technology is changing so rapidly that you can't possibly equip schoolkids with the hard skills of the future, because they'll be obsolete before they reach the workforce... the only way to equip children for the future of work is to develop their imagination, creativity and emotional intelligence. If the world is changing, the best thing you can do is equip them for change. They need to be emotionally resilient with a habit of self-directed lifelong learning."

(Article in Sydney Morning Herald 31 May 2017)

National Reconciliation Week (NRW) 2017

This Sunday 28 June 2017 is Aboriginal Sunday in the churches of Dubbo.

National Reconciliation Week runs from Saturday 27 May to 3 June 2017.

The theme for #NRW2017 is 'Let's Take the Next Steps'.

"In 2017, we reflect on two significant anniversaries in Australia's reconciliation journey – 50 years since the 1967 referendum, and 25 years since the historic Mabo decision. As we commemorate these significant milestones, we ask all Australians to be a part of the next big steps in our nation's reconciliation journey." (http://www.reconciliation.org.au/nrw/)

"They might have guns but we have flowers" (Paris 2015)

The senseless bombing in Machester of a concert attended by hundreds of young people reminds me of the moving video of a French father and son being interviewed after the Bataclan attacks in Paris in 2015.

Randwick Sydney Children's Hospital Gold Appeal

I thought I missed this telethon appeal but it is not on until 12 June 2017. Its a great cause and 8 year old Dubbo boy Owen Walkom is the face of the appeal this year. This is Owen cutting the ribbon with TV personalities. Donations can be made at any time.

Whistleblowers are offside in Australia

Who'd want to be a whistleblower in Australia? It is difficult enough being a referee in sport but who would be game enough to be a whistleblower in their own organisation? A recent Sydney Morning Herald article reported on some research in this area.

Who'd want to be a whistleblower in Australia? It is difficult enough being a referee in sport but who would be game enough to be a whistleblower in their own organisation? A recent Sydney Morning Herald article reported on some research in this area.

The research showed that whistleblowers in Australia often faced an uncertain future. Griffith University conducted a study of which organisations have policies in place for whistleblowers. They looked for support strategies for those who raised concerns and whether they tried to protect them from reprisal.

The Commonwealth, Queensland and NSW governments scored highly "in terms of having policies in place that encourage and protect workers to speak out about bad behaviour". Apparently, not-for-profit, education and training sector, private manufacturing and retail sectors scored the lowest.

It would be interesing to compare the industries that score poorly on whistleblower protection with those that have a high incidence of bullying & harassment complaints. We need organisational cultures that encourage people to speak up about issues and to shine a light on cover-ups. A parliamentary inquiry is under way to examine whistleblower protections in the corporate, public and not-for-profit sectors.

2017-18 Federal budget - GST on property transactions

A tax measure that may not have received a great deal of attention is that from 1 July 2018 the GST payable by purchasers of property will have to be remitted directly to the ATO on settlement. This mainly affects newly constructed homes and new subdivisions. At present developers remit the GST to the ATO after settlement of the sale but some must be failing to remit it despite having claimed GST input credits. Just another complication for conveyancing transactions.

Pensions, aged care and assets test changes relating to the home

Richard McCullagh, a lawyer specialising in elder law, has written an informative article which summaries changes to entitiements to the age pension and the assets test. These are complex issues for anyone to work through. Financial advice well in advance is required.

Elder abuse & powers of attorney

Elder abuse & powers of attorney

At a recent legal conference legal practitioners were encouraged to be on the lookout for elder financial abuse, which could arise in transfers of property, wills and powers of attorney. It seems that the misuse of powers of attorneys is on the increase.

Solicitors have a duty to act in the best interests of their client. If someone appointed under a power of attorney is acting inappropriately, it will be necessary to tell them so and write to them. It may be necessary to revoke the power of attorney and in some situations make an application to the Guardianship Division of the NSW Civil & Administrative Tribunal (NCAT) or Supreme Court.

Where there has been suspicious financial conduct by someone appointed as an attorney social workers and nursing unit managers with a genuine concern have made applications to NCAT.

Whistle blowers - a sorry history of mistreatment

"I have always admired whistle blowers. They are often brave people the establishment does not want to hear from. They are often sacked, demoted or criticised for their roles. They are often women."

(Stephen Walmsley SC author of The Trials of Lionel Murphy published by LexisNexis and referred to in the article in the Law Society Journal Issue 32 April 2017 Lessons from a High Court Scandal

Useful domestic violence (DV) links and statistics

White Ribbon Australia DV statistics

The Law Handbook Chapter 21 Domestic violence

National Domestic and Family Violence Bench Book

Speak up about bullying for yourself and others

Last Friday 17 March 2017, St Patrick's Day, was National Day of Action Against Bullying & Violence.

In the Daily Liberal was an article Stand up to bullying today and everyday which referred to Headspace and Kids Helpline 1800 551 800.

This March on ABC TV, iView and online the ABC Our Focus is on bullying.

The ABC site has links to useful resources and helplines.

Fifty Shades of misbehaviour is unacceptable

Fifty Shades of misbehaviour is unacceptable

Last Wednesday was International Women's Day.

I don't wish to spoil anyone's fun. I should most probably not comment at all as I have not having read any of the Fifty Shades of ... series or watched the movie versions. The decription of "mummy porn" has not inspired me. I have read however, Fifty Sheds of Grey.

Wouldn't most of us agree that sexual harassment, bullying & harassment, the inappropriate use of power, breaches of code of conduct, grooming and stalking are all mostly unlawful?

Recently, I heard of a male professional displaying a range of inappropriate behaviours to the female professionals in a meeting, including, an aggressive manner, standing over them, "crotch display" and slamming doors.

Do some of us men not understand that Fifty Shades of ... [whatever] is fiction and that the behaviours portrayed are largely unacceptable in our society?

Today is International Women's Day - 8 March 2017

The theme this year is to Be Bold For Change and calls on us all to forge a better working world, a more gender inclusive world.

Le'ts celebrate our mums, sisters, daughters, nannas, the women in our lives and the women we work with! Not to mention how well Australian women have been doing in the rugby, soccer, water polo and cricket.

Go to the International Women's Day site

Catholic Schools Week from 5 to 11 March 2017

For sometime the media has been full of disturbing revelations about systemic problems in the Catholic Church and it's institutions. Damning allegations have been made about hierarchial structures and coverups. There have also been the reports of legal actions against the Church and its schools by students, parents and teachers.

At last a good news story. See article Showcase great education in Daily Liberal 6 March 2017

Roadblock for Uber drivers - they need to register for GST

Recently Uber lost a battle with the tax office. A court held that Uber must pay GST. Uber drivers must be registered for GST and pay GST to the ATO from their fares.

(See the ATO's sites on ride sourcing and tax obligations)

While on GST, are your suppliers registered for GST?

A condition of claiming GST credits on purchases for your business is that the supplier must be registered for GST and you have an tax invoice. It migh pay to check your supplier on the ABN Lookup site.

Stolen generations compensation

Maithri Panagoda from Carroll & O'Dea has written an interesting article about the struggle for justice by the stolen generation.

The article gives a history of claims and an outline of the proposed reparation scheme in NSW.

Maithri worked as a solicitor in Dubbo for many years and is an adjunct professor at the University of Notre Dame Sydney.

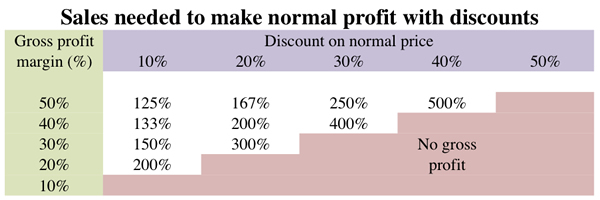

Discount sales, are they worth it? What turnover will you need from them?

An old client Bill used to say, "You can go broke just as quick sitting at home as when you work for nothing or don't get paid." After the Christmas sales results have come in it seems that some retailers have discounted to the point that they were not covering costs.

Sometime ago I saw an article by an accountant pointing out that discounting can be a slippery slope. We need to think about the sales required at the discounted price to make the same profit as selling at the normal price. Will the discounted price lead to the required increased sales and whether there is even a market for that much more product?

When retailers think of their markup, they may think they have more room to discount than they really have. Price = the cost of goods sold + a markup (% increase) e.g. If the cost of goods sold is $50 and the markup is 100% (i.e. $50) the price will be $100. Gross profit is that part of the sale price that is profit after allowing for the cost of the goods sold. Gross profit = price - cost of goods sold e.g. if goods are sold for $100 that cost $50 the gross profit would be $50. Gross profit as a percentage would be $50/$100 = 50%. In this example the gross profit is 50% which is not the same as the markup which was 100%.

Another thing to keep in mind is that in the above example is that if the normal price was discounted by 50% the discounted sale price would only be covering the cost of the goods sold. Discounting by that much generates no profit whatsoever to meet other operational costs.

Damages of $625,345 for workplace bullying

Damages of $625,345 for workplace bullying

A case manager for the Department of Human Services in Victoria was recently awarded damages of $625,345 for injuries as a result of workplace bullying. Costs would normally follow the result.

In a lengthy judgement the Victorian Supreme Court was satisfied that the Department breached its duty of care and that bullying and harassment in 2007 and 2008 by a supervisor exacerbated a pre-existing condition of which it had notice since 2005.

The decision looked in detail at the bullying and harassment behaviours and analysed what the Department could have done better. Supervisors, counsellors and HR could benefit from looking at these sections of the decision. Although the decision is lengthy it is well indexed.

Imagine the distress for workers when incidents occuring in 2007 and 2008 take until 2017 to be decided by the court. The extent to which these claims are contested is indicated by a related application in which the Department sought to recall the worker to be further cross-examined after already having spent three days in the witness box.

(Wearne v State of Victoria [2017] VSC 25)

ATO data matching and super guarantee levy crack down

Different matters but the ATO has said that it is collecting data from financial institutions and online sites for data-matching of card usage, online sales and ride-sourcing.

For more information see the ATO site.

The federal government is also looking at creating a multi-agency group to crackdown on superannuation guarantee levy non-compliance. The ATO is already very active in this area.

For more information see the federal government media release.

Employing backpackers? You need to register with the ATO by today 31 January 2017

If you employ backpackers you need to register with the ATO by today, 31 January 2017. On 1 January 2017, tax rates changed for working holiday makers who are in Australia on a 417 or 462 visa, the "backpacker tax".

From 1 January 2017, employers must withhold 15% from every dollar earned up to $37,000 with foreign resident tax rates applying from $37,001 earned. Employers will have to issue two payment summaries for the 2016-2017 financial year. If employers do not register, penalties may apply and they will have to withhold at the foreign resident tax rate of 32.5%.

Confidential workplace practices

Confidential workplace practices

In a recent article Tom Bell of Shred-it Australia was reported as saying that lawyers need to be mindful of unsecure practices in offices that put confidential information at risk. The risk areas he pointed to apply to all offices.

Leaving confidential information exposed on documents on unsecure copying, scanning and print stations. Confidential information left on messy desks for everyone to see, including clients/customers and cleaners. Unsecure recycling bins can leave confidential information accessible to others. The use of portable devices such as laptops, smartphones, iPads, portable harddrives and USB drives away from the office are also at risk of security breaches.

(Lawyers Weekly January 2017)

Catholic parish takes jurisdictional point in unfair dismissal case

Apparently, the Catholic Church employs more than 180,000 workers in Australia across various services. However, for an employee of the Ku-Ring-Gai parish, the Diocese argued that it falls outside the jurisdiction of the Fair Work Commission because the parish was the actual employer and it employed less than 15 people.

When asked about the unfair dismissal claim by the employee, a human resources representative of the diocese is reported to have said, "I'm not aware of any grievance procedures that apply or that you would need to follow."

We wish you all the best for Christmas and the New Year.

We will close on Thursday 22 December, 2016 at noon and re-open on Monday 9 January, 2017 at 9.00 am.

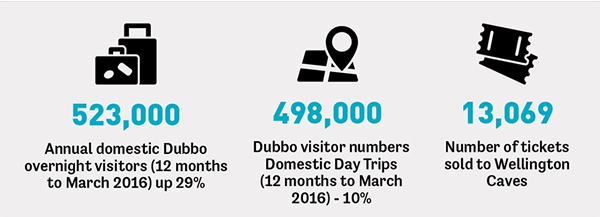

A year in review - Dubbo Regional Council - 2015/2016 Annual Report

Council's annual report is now available to download. Even if you don't read the whole report at the link below are some interesting snapshot statistics like the one above.

Dubbo Regional Council Annual Report 2015-2016

Incorporated associations - 2016 changes for constitutions

From 1 September 2016 amendments to the incorporated associations legislation came into effect. Section 25 of the Associations Incorporation Amendment (Review) Act 2016 deems parts of the model constitution to be included in all the constitutions of associations, which do not address certain compulsory matters.

Recent compulsory matters include postal voting, financial year, maximum terms for office bearers, electronic voting and winding-up.

For the deemed changes to the constitutions to take effect, associations do not have to pass a special resolution, do not have to register any change and need not do any other act or thing (section 25(4) Associations Incorporation Act 2009 as amended).

On our resources page are some notes about this.

Dubbo doesn't compare too badly on incomes & house prices

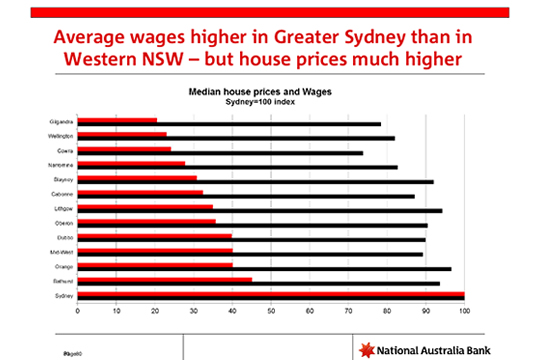

At an interesting talk recently, Tony Taylor, an economist with the NAB, showed the following bar-graph.

The red lines are average house prices as a percentage of the median Sydney house price and the black lines are average wages as a percentage of the median Sydney wage.

Apologies for the small print. Dubbo is 9th from the top in the list. Dubbo house prices appear to be 40% of Sydney prices while wages are 90% of Sydney wages.

Crack-down on pre-insolvency firms by ASIC anors

Apparently, a few weeks ago ASIC, ATO and Federal Police raided pre-insolvency firms in Melbourne and the Gold Coast. There has also been a horror story on the ABC's 7:30 Report.

Registered liquidators must comply with numerous requirements. Pre-insolvency firms are often unlicenced. They may propose arrangements that unlawfully defeat creditors. Be wary of pre-insolvency firms, particularly, when they do not want to work with your existing accountant or solicitor.

Life imitating art? Was "The Castle" used as a precedent in the High Court?

Life imitating art? Was "The Castle" used as a precedent in the High Court?

Yesterday, ABC radio PM commentators reporting on a recent High Court decision thought it was reminiscent of the movie "The Castle". Some of the notoriously generous pension and life gold pass benefits of retired members of Federal parliament have been whittled away since 2012. Four retired members of parliament, Barry Cunningham, Anthony Lamb, John Moore and Barry Cohen brought a case before the High Court.

The commentators noted that the grounds of the action sounded similar to those raised in the movie "The Castle". The plaintiffs argued that the legislation allowing their benefits to be reduced was an acquisition of property otherwise than on just terms within the meaning of section 51(xxxi) of the Constitution.

Having a quick look at the long judgment, their Honours did not tell the plaintiffs that they were "dreaming" (as Darryl Kerrigan was fond of saying) but a statement from the Court does say:-

"The High Court unanimously held that the retiring allowance amendments were not laws with respect to the acquisition of property, nor did the Determinations constitute an acquisition of property. A majority of the Court held that the entitlements to retiring allowances were inherently liable to variation …"

Westpac admits to raiding piggy banks

Apparently, Westpac has admitted to ASIC that it failed to remove the monthly fees from the accounts of young customers.

(See article in Sydney Morning Herald 14 September 2016)

September is Dementia Awareness Month

September is Dementia Awareness Month

The theme of this year's national awareness month for dementia is "You are not alone".

If it sounds to good to be true? - Airtasker taken to task over claims

"Consumer advocate Choice is demanding Airtasker back up claims that workers can earn "up to $20,000 a month" by completing random tasks through the odd-jobs website."

"The company operates on a similar business model to Uber and Airbnb and collects a commission [15% service fee] from workers using the site."

(From article by Georgina Wilkins in Sydney Morning Herald 23 August 2016 )

62% of men & 66% of women in the AFP said they had been bullied

Victims are urged to come forward as a result of a shocking report from a study conducted on behalf of the Australian Federal Police.

The AFP Commissioner reportedly admitted that internal processes for dealing with complaints wer inadequate and new processes would make sure that victims were not, "revictimised every time they tell their story". Many of those surveyed complained of being ostracised.

(Sydney Morning Herald article Bullying, harassment rife in Federal Police 23 August 2016)

School teacher successful in appeal by Diocese of Bathurst

The Trustees for the Roman Catholic Church for the Diocese of Bathurst have unsuccessfully appealed against the decision of the Workers Compensation Commission to remit for assessment the degree of permanent impairment of a teacher due to a work related injury.

The Trustees for the Roman Catholic Church for the Diocese of Bathurst have unsuccessfully appealed against the decision of the Workers Compensation Commission to remit for assessment the degree of permanent impairment of a teacher due to a work related injury.

The notice of injury on 18 May 2010 was disputed by the insurer and referred to the Commission for determination on 15 November 2012. The matter was settled at a conciliation conference on 27 August 2013 on the basis that the worker was paid weekly compensation, medical expenses and costs increased by 30%.

On 12 February 2014 the worker made a claim for compensation for permanent impairment resulting from the injury, which the insurer disputed based on the settlement of the initial claim. The Deputy Commissioner held that the worker was not precluded from making the claim. The appeal to the Supreme Court against the decision of the Deputy Commissioner was unsuccessful.

Some sobering thoughts emerge from this case, including: the extent of the serious injuries that can occur in non-manufacturing industries; the lengths a worker may have to go to and the time it may take to obtain compensation; and huge personal, medical and legal costs of workplace claims. Surely the money would be better spent trying to make workplaces better.

(Trustees for the Roman Catholic Church for the Diocese of Bathurst v Hine [2016] NSWCA 213)

20% growth in prisoner population over last two years

The NSW Bureau of Crime Statistics and Research (BOCSAR) reported that the NSW adult prison population grew by 6.5 per cent between July 2015 and June 2016, reaching 12,550 in June. This brings the total increase in the NSW adult prison population over the last two years to 21 per cent.

The NSW Bureau of Crime Statistics and Research (BOCSAR) reported that the NSW adult prison population grew by 6.5 per cent between July 2015 and June 2016, reaching 12,550 in June. This brings the total increase in the NSW adult prison population over the last two years to 21 per cent.

"The increase is attributable to a growth in prisoners on remand (i.e. unconvicted prisoners awaiting trial or sentence)," the agency said. "Between July 2015 and June 2016 the number of adult prisoners on remand grew by 14.8 per cent (from 3,633 to 4,170). Over the same period, the number of sentenced prisoners rose by 2.8 per cent (from 8,148 to 8,380).

BOCSAR expected further growth in the prisoner population over at least the next eight months with the prison population forecast to reach just under 13,500 in early 2017.

(MondayBriefs Law Society of NSW 1 August 2016)

In 2013-14 it cost on average $292 per day to keep a prisoner in gaol and about twice that amount to keep a juvenile in a detetion centre. This was at a time when Australia's average daily earnings were about $160.

(Civil Liberties Australia 22 June 2013)

(Productivity Commission report on corrective services 2016)

Family pledges are really guarantees

Family pledges are really guarantees

A few banks are promoting a product called a "family pledge" as a way to help family members borrow to buy a home. This has great benefits for particularly first home buyers who would otherwise struggle to meet lending requirements. It may allow mortgage protection insurance to be dispensed with and save the borrowers having to pay a substantial one-off premium.

It is important for the family members providing assistance, usually parents, to know that they are usually required to sign a guarantee and indemnity for the lender. In addition the lender may require security to support the guarantee, which means the parents will have to allow the lender to register a mortgage over their home.

Parents should keep in mind that there are risks associated with giving guarantees. The borrowers may lose their jobs, have unexpected children or health problems or may separate. It is possible for the borrowers to take out income protection insurance and life assurance but these come at an additional monthly cost. The guarantee documents usually allow a lender to pursue the guarantors even thought they have not fully exhausted their remedies against the borrowers. The existence of the mortgage on the parent's home will also restrict what they can do or borrow.

Trade agreements and export markets, Beginner's guide to

A recent article emphasised the need to research the risk and possible rewards of exporting and making use of the Free Trade Agreements (FTAs) Australia has entered into.

It was suggested that a good place to start was the business.gov.au site. This portal has targeted information, answers frequently asked questions and can identify the Harmonized System (HS) codes that apply to products.

Uber legalised in NSW

The NSW Point to Point Transport (Taxis and Hire Vehicles) Act 2016 No. 34 commenced on 8 July 2016.

An article about the Uber contract for driver-partners gave clauses in the contract some great descriptions e.g. the DIY clause, the "fairground" clause, the Go your own way clause, the Uber yourself clause, Green tomatoes clause and the Netherlands clause. The dean of law at Sydney University was reported as saying, "I would be loath to sign this contract."

(The Uber contract's nasty details by Georgia Wilkins in the Sydney Morning Herald 26 May 2016)

(See also the ATO also has a page about the sharing economy and tax)

Dr Google - Dr Law? I think not.

Dr Google - Dr Law? I think not.

"Dr Google is a good example," says Legg. "People go online and are happy to diagnose their symptoms but those people are not going to perform an operation on themselves. I think law is going to be similar. At a certain point, the risks or the expertise that is needed will make them think, "I need to see a lawyer about this."

"Legg [Michael Legg, Associate professor University of NSW] says that while low-cost alternatives may be attractive to some, there will always be a market for lawyers with professional experience and accreditation."

(Future of the profession Law Society Journal Issue 22 May 2016)

Good news - abolition of some NSW duties from 1 July 2016

Duty on the transfer of business assets or a declaration of trust over 'business assets' (other than land) will be abolished from 1 July 2016. A business asset is defined as things such as goodwill, intellectual property or a statutory licence.

Duty on all mortgages is abolished from 1 July 2016. Shares in a NSW company and units in a unit trust scheme registered in NSW ceases to be dutiable property from 1 July 2016.

A few nasties in the NSW State budget for foreign purchasers

The NSW Budget introduced from 21 June 2016 a 4% surcharge purchaser duty on the purchase of residential real estate by foreign persons . The surcharge is in addition to the purchase duty payable on the purchase of residential property in NSW.

The surcharge will also apply to landholder transactions a foreign person purchases shares or units in a landholder. All transferees who are liable to pay duty in respect of a dutiable transaction must lodge a declaration in the approved form.

The budget also introduced a 0.75% surcharge land tax on the taxable value of residential land owned by a foreign person. The tax will be separately assessed in relation to each parcel of land and is payable in addition to any land tax otherwise payable by a foreign person. There will be no tax threshold to exempt land below the specified value nor any exemption for land occupied by a foreign person as a principal place of residence.

(From NSW Office of State Revenue)

UN World Elder Abuse Awareness Day - 15 June each year

15 June every year is the United Nations internationally recognised World Elder Abuse Awareness Day.

15 June every year is the United Nations internationally recognised World Elder Abuse Awareness Day.

Quite disturbing information about elder abuse has been coming to light for a number of years. See some facts and a Western Australian report from 2011. Types of abuse include physical abuse & neglect, emotional & financial abuse. The target is usually vulnerable and the offender is most commonly a close relative.

Some informative and useful sites include:-

- Seniors Rights Service

- NSW Elder Abuse Helpline & Resource Unit

- NSW Police Force - Domestic & family violence - Elder abuse & neglect

- Seniors Rights Victoria

- Elder Abuse Prevention Unit - UnitingCare QLD

- Australia Ageing Agenda

- Advocare

- ABC Radio - Elderly abuse cases on the rise

Swimming pool certification process flowcharts

The Western Plains Regional Council (formerly Dubbo City & Wellington Councils) has prepared a couple of useful flowcharts setting out the procedures for obtaining compliance certificates to meet the new swimming pool & spa requirements.

There is a flowchart (click here) for preparing to sell a property with a swimming pool &/or spa and another flowchart (click here) for landlords renting a property with a swimming pool &/or spa.

National Reconciliation Week from 27 May to 3 June

National Reconciliation Week started on 27 May, which is the anniversary of the 1967 referendum and goes to 3 June, which the anniversary of the Mabo decision of the High Court of Australia in 1992. The Mabo decision recognised that Aboriginal and Torres Strait Islander people have a special relationship to the land. The 1967 referendum gave the Federal government constitutional power to make laws relating to Aboriginal people and included Aboriginal people in the counting of the population of Australia.

Reconciliation Australia provides more information about National Reconciliation Week and some resources. They also have a site for those interested in developing reconciliation strategies or a reconciliation action plan (RAP).

Do you remeber your first computer or would you rather forget it?

Do you remeber your first computer or would you rather forget it?

I look back fondly on my first computer. It was an Apple IIe with a separate green-screen monitor and two five and one-quarter floppy disk drives. That was in 1983. I recall that Commodore and Amiga were early brands of computers with the IBM PC becoming available after that. These were all DOS machines. The graphical user interface was not common until the Apple Macintosh came along. I had an early Macintosh SE. I thought I was very lucky at the time to have a 10MB hard drive.